5 Reasons Why You Should Invest in a Property

There is a reason (or multiple in fact!) why property investments are so widespread and popular that people . In fact, property investments have even been touted as one of the best forms of investment. From gaining passive income to future property funding, a way for you to leverage power, risk diversification, and increased capital appreciation; these are just some of the many reasons why you should invest in a property and is the best choice you can ever make.

Rental Income

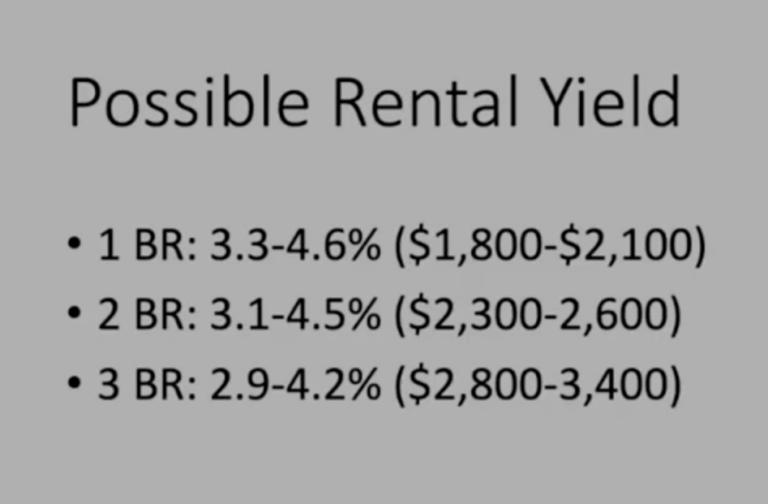

One key benefit of property investment that often comes to people’s minds first is how rental income can earn you a steady stream of passive income. Be it renting out the entire unit, or simply renting a single room, it is a relatively simple and easy way for you to earn additional income on the side.

If you are renting out the entire unit, take note that you would have to consider mortgage payments, the cost of stamp duty, as well as house upgrades or repairs before you can rent the unit out. As such, you will require to invest a certain amount of money initially, but in the long run, you will be able to steadily earn a stream of income without doing much.

On the other hand, renting out part of your home is also a great way to earn passive income to fund your monthly home mortgage as well. By renting out your property, you can still go about your day job, and yet, attain two steady income streams and better cash flow. In Singapore, there is also a net rental yield of approximately 2.3%.

Future Property Funding

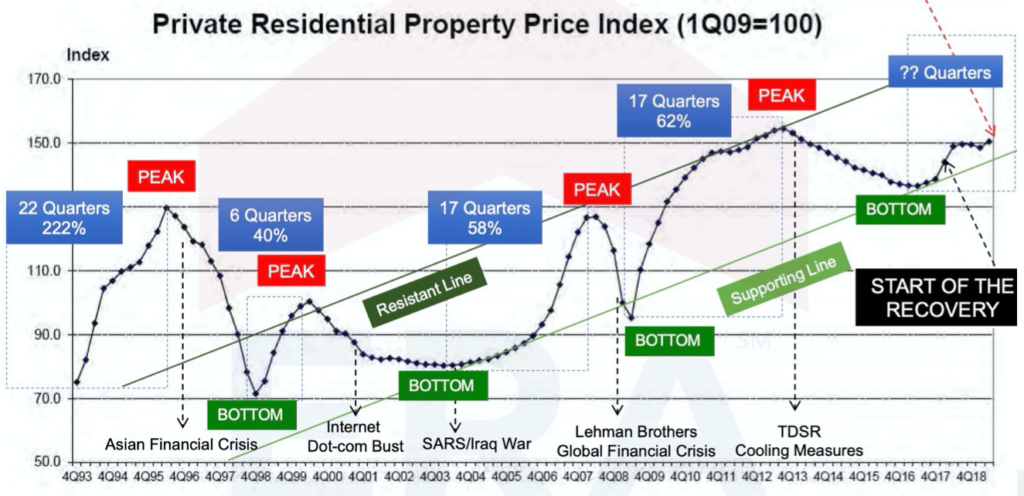

Another reason why property investment is the best investment? It allows you to enjoy future property funding. What this means is that almost every property investment can earn you sufficient profits to not just earn you good money, but also fund your future property investment for more profits in the long run.

In fact, this is also one reason why people love investing in properties – because they can earn increasingly more money after each property investment. And why is this so? This is because property prices in Singapore follow an upward trend, and the highest spike is typically after each property cycle of about 7 to 10 years. And while it is possible to be on the wrong side of the property cycle and suffer losses from selling one’s property, with sufficient knowledge and research, most investors can increasingly earn more profits from the growing property prices after each property cycle.

The Power of Leveraging

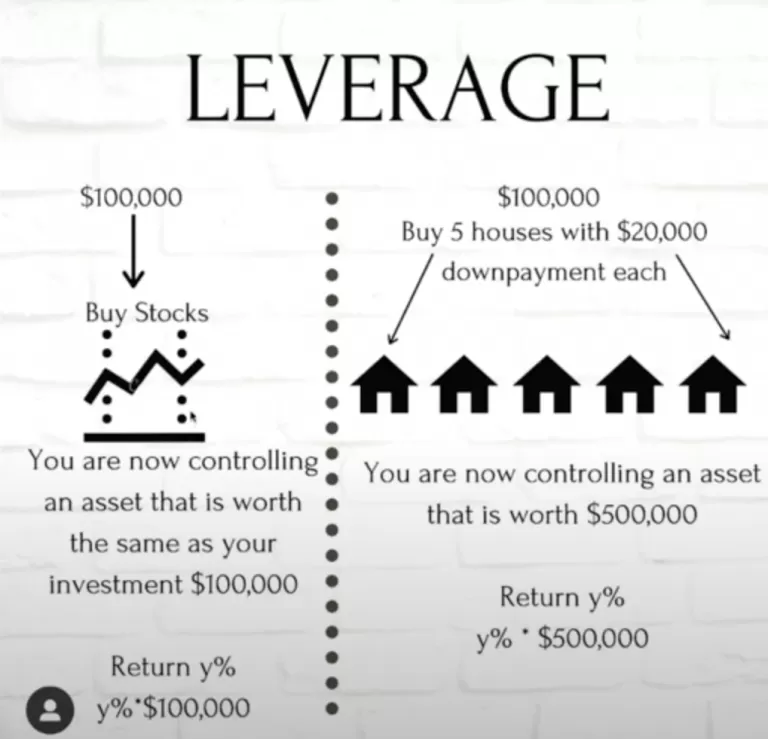

Investing in properties can also give you the power of leverage. What this means is by making use of different financial tools or borrowed resources, you can boost your potential possible return from investing. In the case of property investment, the most frequent approach to leverage your property investment is through a mortgage, or by using your own money.

For instance, a 20% down payment on a mortgage can help you buy 100% of the house you want, therefore giving you the power of leverage. Property investing can give you this benefit because real estate is a tangible physical asset that may serve as collateral, and you can be readily financed. At the same time, the power of leveraging works effectively well for property investment because property prices in Singapore are generally on an upward trend.

Check out our article ” 15 or 30 year mortgage, which is a better choice?“

Risk Diversification

Did you also know that investing in properties provides risk diversification? This is why property investments are the best kind of investments. But what exactly is risk diversification? Like the saying “don’t put all your eggs in one basket”, risk diversification ensures that you diversify your investments and minimises the risk of losses in the long term.

At the same time, it also decreases the overall volatility of your portfolio and enhances the risk-adjusted returns. In the case of property investments, there are numerous ways to diversify your investments and reduce the risks. For instance, you can choose to invest in a property and rent it for a more passive income, or choose to purchase it for investment purposes.

Property investments are also not limited to residential properties in Singapore. For instance, industrial properties are another type of property investment available in Singapore that you may choose to pursue to further diversify your portfolio.

Commercial properties (such as shopping malls, office buildings, market and food centres, some mixed development, and restaurants) are also another investment to diversify your investments and reduce the risk of volatility. All of these are unique to property investments, therefore making property investments a comparatively risk-free type of investments and one of the best forms of investments.

Capital Appreciation

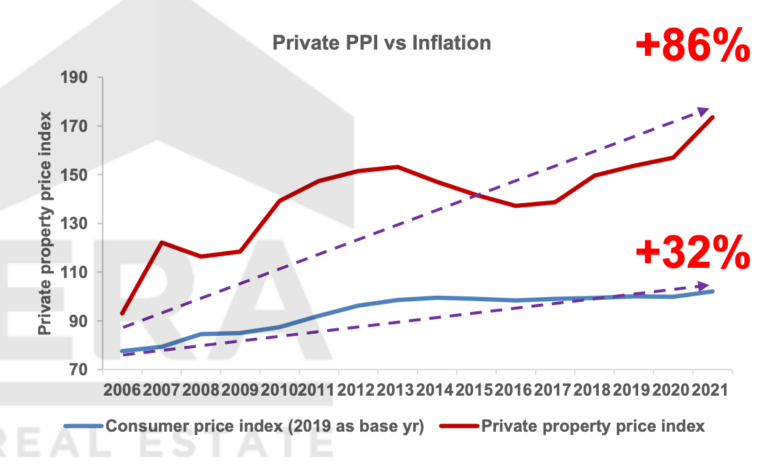

Last but not least, investing in properties can also provide you with the benefit of capital appreciation. But what is capital appreciation in the context of property investments? It is the percentage of investment in which market price increases surpass the initial investment’s acquisition price or cost basis. Or in simpler terms in the context of property investments, you gain capital appreciation when you sell your property for a better price than when you first initially bought it.

For instance, if you purchase an executive condo 4-room for 1 million and sell it 7 years later for 1.5 million, you’ve made half a million capital appreciation. And for property investments, capital appreciation is almost guaranteed due to inflation hedging, where there is a growing economy, rising rental rate, and demand for more properties in Singapore. And with increased demand for properties, your investment in properties can earn you capital appreciation in the long run.

Check out our article “Top 5 Recommended New Launch Condo for 2022” to get out top recommendation.

Conclusion

With so many benefits to investing in properties, it is no wonder why property investments are such a popular and recommended form of investment in Singapore. However, keep in mind that extensive research and sufficient knowledge are required for you to fully reap the benefits of investing in properties. The lack of it can lead to poorly informed choices and minimise your profits, or even cause you to lose money.

To prevent that, let us work together. Let me handle all the paper work and financial matters. I will coordinate and go through the entire process with you to ensure a reliable and hassle-free experience as you embark on your journey to invest in property.

For instance, if you purchase an executive condo 4-room for 1 million and sell it 7 years later for 1.5 million, you’ve made half a million capital appreciation. And for property investments, capital appreciation is almost guaranteed due to inflation hedging, where there is a growing economy, rising rental rate, and demand for more properties in Singapore. And with increased demand for properties, your investment in properties can earn you capital appreciation in the long run.

Check out our article “Top 5 Recommended New Launch Condo for 2022” to get out top recommendation.