5 Costly and Common Mistakes Homebuyers Make

Buying your perfect home, especially if it is your first, may be a challenging task. Your emotions are boiling with joy, but they are also brimming with issues, and you are on an emotional rollercoaster. If you are not careful, buying a new home may be exhausting and terrifying.

Despite the fact that owning a home is likely to be the most significant financial transaction you will ever make; it is common to find home buyers who are unprepared and unable to make an informed purchase decision. It is not their fault, either.

Here’s the good news: you will have a better understanding of the complicated procedure as you gain more real estate purchasing experience.

But in the meantime, let me help you avoid the 5 costly and common mistakes homebuyers make!

1. Not Having a Clear Objective when Buying Property

Setting clear, defined objectives is essential. “I want to buy a house” is not a goal — at least, not in the sense that it should be. Instead, “I intend to buy a BTO 4-room flat within three years for a maximum spend of $300,000 and pay off my property loan within 25 years,” for example, is a goal – a SMART goal that is Specific, Measurable, Achievable, Relevant, and Time-Bound,

Setting a defined, quantifiable, and time-bound objective can assist you in staying on track to obtain the home you desire. This is especially crucial if you are looking for a property with your partner (as many new home buyers do), because you may have different priorities, and striking a balance is necessary to avoid future dissatisfaction.

2. Being Swayed by Emotions or Feelings

It is not a good idea to let your friends or the market affect you more than your own particular needs. You will be the one to live on the property and move in. As a consequence, regardless of what others say, the decision should be made by you. You should not acquire a small unit if you expect to build a family, for example.

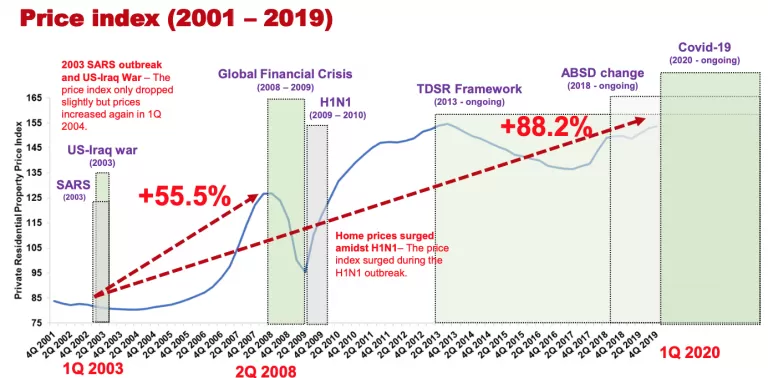

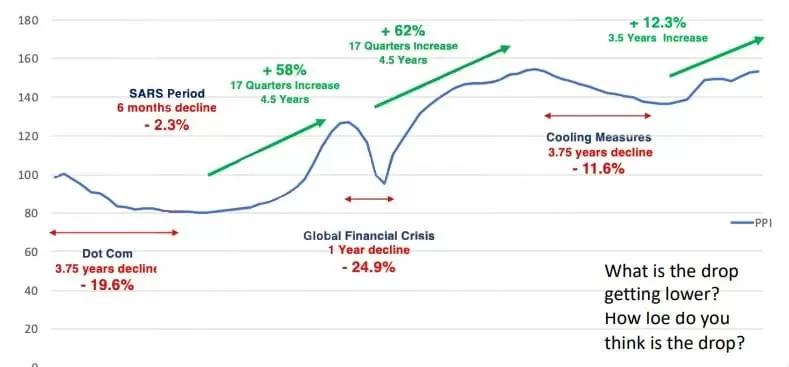

Contrary to popular belief, just because someone urges you to do something does not mean it is a good idea! I have seen the market work in the buyers’ favour on a few instances. On the other side, there are “sellers’ markets” or situations where prices are extremely high. The cycle of the real estate market is well-known.

Waiting for “ideal timing” or for expenditures to fall is, on the other hand, a risky bet with your family’s future. What do you think a “suitable moment” is? Personally, I do not believe in the concept of a “suitable occasion.” Finding your “Mr or Mrs Right” is the same way — all it takes is a little planning and periodic expectations management along the road to discover the “perfect moment”.

Unfortunately, many people are led by their emotions, which can lead to buyer’s remorse. Allowing your own preferences, sentimental ties, or prejudice to affect your judgment on any issue is never a smart idea. It makes sense – purchasing a home is a very emotional experience. However, the best tactics are to make a budget, keep track of your money, and assess your present and future demands.

3. Not Doing Enough Research

When performing property research, there are both local and macro factors to consider. Both of these factors will have a significant impact on home values.

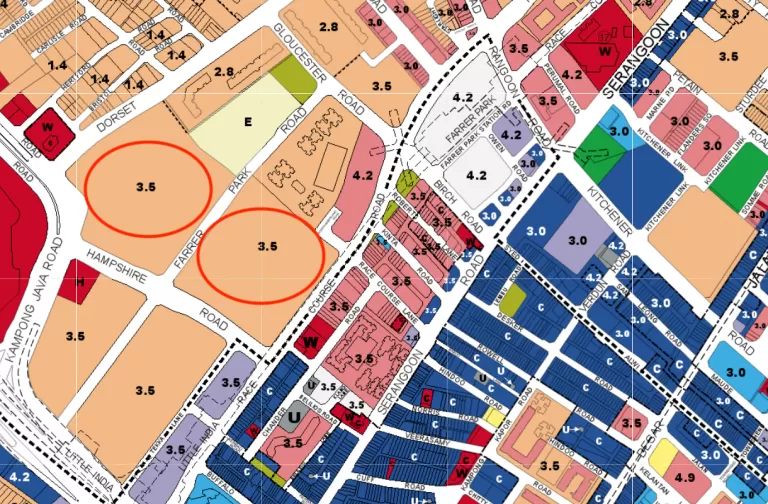

On a micro level, determine the magnitude of the development. A tiny development often symbolizes more exclusivity and may command a higher price than a large development due to the demand and supply dynamic. On a macro level, determine the amount and type of developments in the region. If you decide to sell your home, this will give you an idea of how competitive it will be.

You might also be interested in learning about the area’s unique characteristics, such as closeness to water or natural parks. Furthermore, keep an eye out for any tell-tale signs. Are there any vacant land parcels? What are some of the most likely uses for them? What is the Urban Redevelopment Authority’s (URA) Master Plan for the area’s future development?

You will have a better idea of how to buy a house in Singapore after conducting your property research.

Check out our article on “Top 5 Must Use Free Property Research Tools“.

4. Ignoring the Opportunity

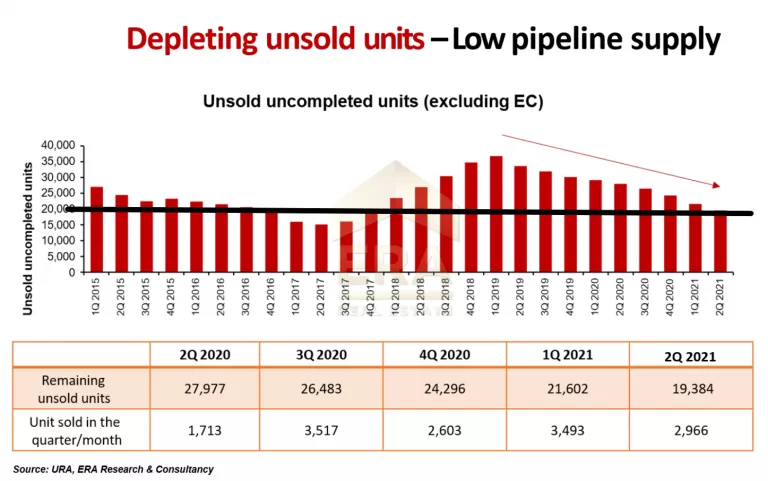

It is a fine line to walk to ensure you make an informed decision without taking too long. It might be upsetting to miss out on a property on which you were almost ready to make an offer because someone else got there before. It might also have financial consequences.

Assume you are a sole proprietor. Perhaps, you place a higher value on time than others do. The less time and energy you have to work, the more time and energy you spend looking for a home outside of your usual activities. It is possible that your firm’s future performance will be crucial to paying the mortgage.

If you do not take action right away, someone else will, and you will have to keep looking. Do not underestimate how time-consuming and difficult house shopping may be.

5. Not Having the Holding Power to Keep the Property

When it comes to real estate investing, it all comes down to holding power, or your ability to keep the property even though you owe a lot of money on it. Property, unlike cash or gold, continues to cost you money even if you keep it. Maintenance fees (which are typically $1200+ per quarter for mass market condominiums), property taxes, your mortgage, and other upkeep costs must all be paid.

You do not have holding power if you rely on a tenant’s rental revenue to make loan payments, for example. You will have to sell swiftly and at a loss if the rental market crashes. Having holding power also means that financial setbacks will not disrupt your long-term goals. If you are laid off and must take a lower wage, you are unlikely to sell your home during a market downturn.

Investing in real estate may not necessarily turn out badly due to “market forces”. It goes wrong due to medical emergencies, under-insurance, divorce, and other issues. These characteristics will damage your home investment even in a bull market.

In addition, many consumers underestimate the entire costs of acquiring a home. When calculating how much they can afford, most first-time buyers emphasise on the monthly loan servicing amount and down payment, but they frequently overlook additional costs such as legal fees, valuation report costs, and stamp duty, which I have noticed in my years in the industry.

When I explain these additional fees to them, eager-eyed first-time homebuyers immediately turn to worrisome-eyed homebuyers!

Many homeowners are also unaware that, in addition to their monthly payment, they must pay property taxes and purchase a mortgage protection plan to protect their house from calamities.

Finally, there is the notion of home maintenance, which is setting money aside for repairs when things go wrong. I did the same thing when I first bought my property, and I encourage that homeowners think about monthly maintenance costs as well if they wish to buy and live in a condominium.

Check out our article on “8 Basic Real Estate Calculations Every Property Investor Must Know“.

Avoid these Mistakes with Me!

Because of the sophisticated lexicon and mechanics of buying a house, it is all-too-easy to make the wrong judgment or invest in an unwise way. If you are a looking to buy a home, I can help you to avoid some of the most costly and common mistakes homebuyers make to avoid buyer’s regret.

Schedule an appointment with me now and let your property purchase journey be a breeze. I look forward to speaking with you real soon!