An Analysis of 1 Bedrooms Condo as an Investment Property in Singapore

Always on the lookout for the latest real estate buzz? You’d be familiar with the news that one-bedroom units—in any new launch—sell like hotcakes. Just take a look at the most recent launches! Midtown Modern at Tan Quee Lan Street saw 90% of one- and two-bedroom units sold during its weekend launch. Similarly, for One North Eden at Buona Vista, which sold 85% of its units at launch, one-bedroom plus study and two-bedroom units proved the most popular, and were quickly sold out at 10 am on the first day of launch. Also, 1 of the most frequently asked questions that my investors ask me is whether they should invest in a 1 or 2 bedroom.

If you, like many other property buyers, are drawn to the low barriers of entry of a one-bedroom unit, you might be too afraid to ask certain questions regarding this investment decision for fear of coming off dumb. Lucky for you, we believe that there is no such thing as a stupid question, especially when it comes to a big investment decision like purchasing a property. Today, we analyse one-bedroom units to answer these questions specifically:

- Should I focus my attention to one-bedroom units in prime and central regions?

- Do one-bedroom units have better rental yields?

- Do returns get better after longer holding periods?

- Am I better off picking leasehold or freehold units?

Should I focus my attention to one-bedroom units in prime and central regions?

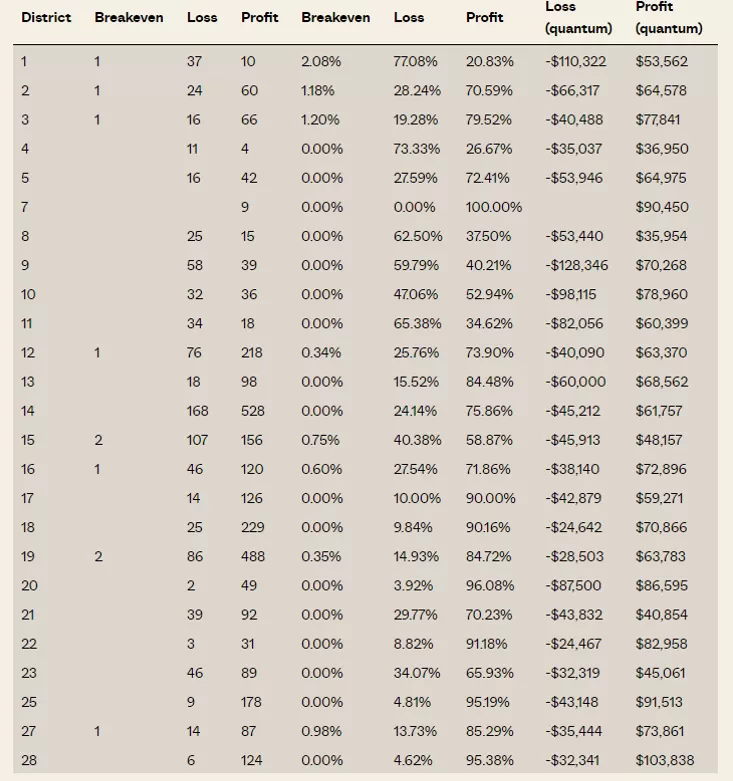

The answer to this question wholly depends on why you are buying the unit. If you are looking to rent out your unit to an expatriate tenant, an apartment unit in prime and central locations such as District 9 or 10 would be extremely attractive. Aside from rentability, however, you may want to consider the one-bedroom unit in terms of profitability. When it comes to profitability, the opposite is said to be true—one-bedroom units in central regions sport the lowest percentage of profitable transactions:

As seen from the table above, in District 1, which includes areas like Marina Square, Suntec City, and Raffles Place, 37 out of 48 transactions were unprofitable. In the same vein, in prime District 11, which sees areas like Newton, Bukit Timah, and Novena, 34 of the 52 total transactions were unprofitable.

If you’ve got a keen eye, you might have noticed that District 7, which is arguably close to prime region with areas like Bugis and Beach Road, managed to score a 100% in terms of profitability. While that may point to something larger, it is essential to note that only nine transactions were recorded, pointing to the credibility and usefulness of this result.

Taken together, if we look at the top 10 districts with the most profitable transactions, none of them are from the core central region (CCR) of Singapore. Only two districts—7 and 20—are from Rest of Central Region (RCR), and all the others are from Outside of Central Region (OCR).

A possible explanation for this could be the higher potential for appreciation that one-bedroom units in the OCR get to enjoy because of their affordable price and low quantum. While you can easily find a one-bedroom unit in OCR priced below $750,000, the same cannot be said for one bedders in central locations. Do remember, though, that rental yields have to be taken into account! When taking into account your rental income, the overall returns of a less affordable one-bedroom unit in the CCR will definitely give the units at other locations a run for their money.

Do one-bedroom units have better rental yields?

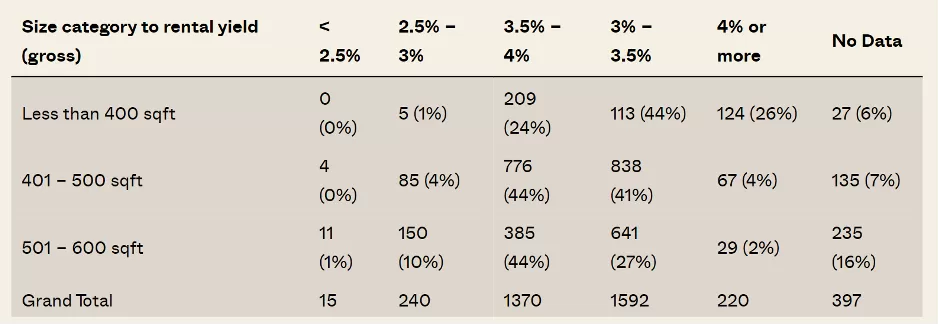

For the uninitiated, the typical gross rental yield of a private residential unit is 2% to 3%. One-bedroom units are often known to fetch greater rental yields as compared to other private property units. Data suggests that this “rumour” seems to be true:

Out of over 3,400 one-bedroom units that were analysed, about 53% (1,812 units) managed estimated gross rental yields of 3% or more. Of the total number of units, only 15 one-bedroom units have rental yields that fell short of 2.5%.

As a result, investors who love collecting rent gravitate towards smaller units such as one-bedroom units.

Do returns get better after longer holding periods?

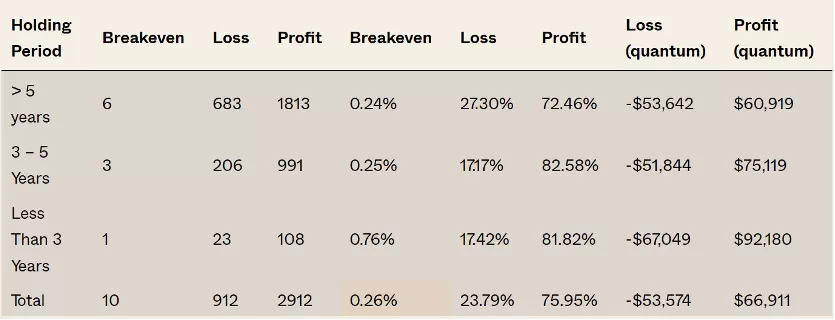

The short answer to this question is no. In fact, the opposite applies: returns can get worse over longer holding periods, as evidenced in the table below:

One-bedroom units that were held for a period of more than five years saw that only 72.46% of it were profitable. On the other hand, one-bedroom units held for three to five years saw a jump in that percentage to 82.58%. The same result is reflected in units with a holding period of less than three years—with 81.82% of them being profitable.

While there can be many reasons for this phenomenon, it is largely believed that this is due to the climbing property prices that the Singapore property market in the years leading up to 2013. Buyers, even those who had limited capital, were eager to purchase property due to the rising property market. Many of them turned to purchasing one-bedroom units, because it is the most affordable option. These buyers likely bought their one-bedroom units at ridiculously high prices and held on to them for more than five years in hopes that they could ride out the down period. This explanation could account for the many unprofitable transactions. Relatedly, these buyers could have gotten sick of waiting for the storm to ride out and chose to sell off their unit at lower prices.

Am I better off picking leasehold or freehold units?

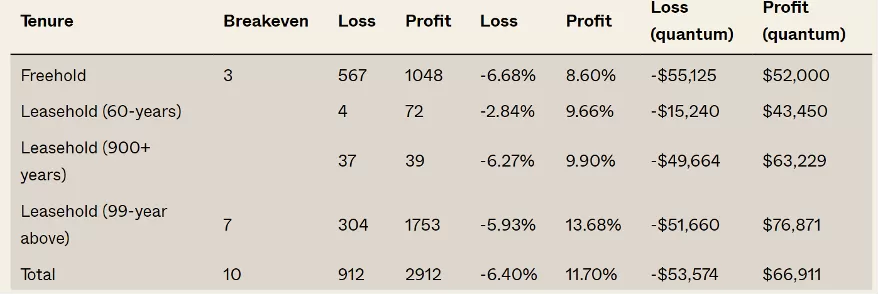

In the realm of comparing leasehold units to freehold units, it may be surprising to some that leasehold units generally outperformed freehold units, as seen in the table below:

In general, leasehold units see 13.68% profitable transactions, as compared to freehold’s 8.6%. This could easily be explained by the fact that freehold units typically have premiums that could go up to 20%. However, if you expect a significant change in this trend when considering holding periods, you’d be surprised. Even when a one-bedroom freehold unit is held for a period of five years, 63% of transactions are profitable. On the contrary, when leasehold properties are held over five years, a significant increase of profitable transactions is evidenced—82.7% of such transactions are profitable.

This finding is extremely telling, because it means that even when you take into account the lease decay of leasehold properties, it’d be a wiser decision for you to pick leasehold one-bedroom units.

The future of one-bedroom units

When you take a look at the data as a whole, profitable transactions significantly outnumber unprofitable ones when it comes to one-bedroom units. What this suggests is that looking to purchase a one-bedroom unit could actually be a low-risk and wise investment decision on your part.

So what are the conclusion?

1. 1 Bedrooms in OCR gives better return than CCR due to being more affordable.

2. 1 Bedrooms have better rental yields than 2-3 Bedrooms. However, they may be harder to sell in future.

3. Leasehold always gives a better return than freehold

However, despite its high rental yield and low quantum, there are certain key trends that might affect the attractiveness of one-bedroom units. First, HDB upgraders tend to look for larger units. This means that one-bedroom units are too small for their needs. In addition, with lockdowns after lockdowns that countries all over the world are facing, there are only a handful of foreign tenants looking to rent your one-bedroom unit. What this all means is that while one-bedroom units continue to sell like hotcakes at property launches, you might find it difficult to sell off in the near future.

Still confused? Don’t worry. A one-bedroom unit may not be the best investment decision for all investors out there. If you’re keen to learn more, contact our friendly staff for a free 1-1 consultation here!