Freehold vs Leasehold Properties: Which is for you?

Purchasing a property is a major milestone in one’s life. When it comes to the process of purchasing a property, there are a myriad of factors to consider: location, size, valuation, loans, tenure and many more.

In this article, we’ll be discussing tenure in greater detail. You probably know that a significant number of Singaporean property buyers out there refuse to consider 99-year leasehold properties and shun them like how they stay away from a toxic ex. For these property buyers, 99-year leasehold properties are like “throwing money into the gutter”, and freehold properties are the only properties worth considering. However, there are convincing reasons why you should not just write off leasehold properties. Leasehold properties hold their own against properties, and we’ll see how they match up throughout the article.

Specifically, we will compare freehold and leasehold properties in six aspects:

Time limit

Cost and value

Rental yield

En bloc offers

Loan restrictions

Legacy planning

At the end of the article, you should be able to decide if a freehold property or a leasehold property is a better choice for you.

Freehold vs leasehold: Time limit

The first obvious difference between the two types of properties is the time limit that you have over your ownership of the property. With a freehold land or property, you own the property and the land that it sits on. It is “free from hold”. This means that there is no time limit over your ownership of it.

Property buyers are attracted to such properties because you never have to worry about being chased out of your home. But if the government buys your residential property to make way for a project such as building MRT lines roads, or bridges, you may have to let go of the property and the land.

This is mandatory under the Singapore Land Acquisition act put in place since 1966. Relatedly, you’ll also have to give up your freehold property if a developer attempts to buy your property via en-bloc. The sale will go on if the majority of residents within your development agree to it. Just look at the example below where Casa Sophia, a freehold property sold en bloc for $29 million!

On the other side of the spectrum, we have leasehold properties. Leasehold means that you only own the property for a fixed period of time. In Singapore, private properties have lease tenures that are usually 99 years or 999 years. The latter is less common in present day Singapore and was frequently used in the past.

Freehold vs leasehold: Cost and Value

In general, a freehold property costs about 15 to 20 percent more than a leasehold property. This is due to the lack of supply of freehold properties. The Singapore government has stopped the sale of freehold land and they have since become rarer than a rare pokemon. As a result freehold properties have a higher price tag as compared to their counterpart.

In terms of value, a popular idea that floats among Singaporeans is that freehold properties are worth more and fetch better value than do leasehold properties. However, this is a misconception. The truth is, not all freehold properties have a higher market value. Some leasehold properties actually have a higher market value because there are many other factors that affect value besides lease.

For example, location matters: a leasehold property with 80 years left would most definitely be worth more that a freehold property in an ulu (remote or deserted) district in Singapore. This also means that if a freehold property is close to an MRT station station and has great connectivity, it’ll be hard to discern how much of the higher valuation is due to it being a freehold property and how much is related to its accessibility.

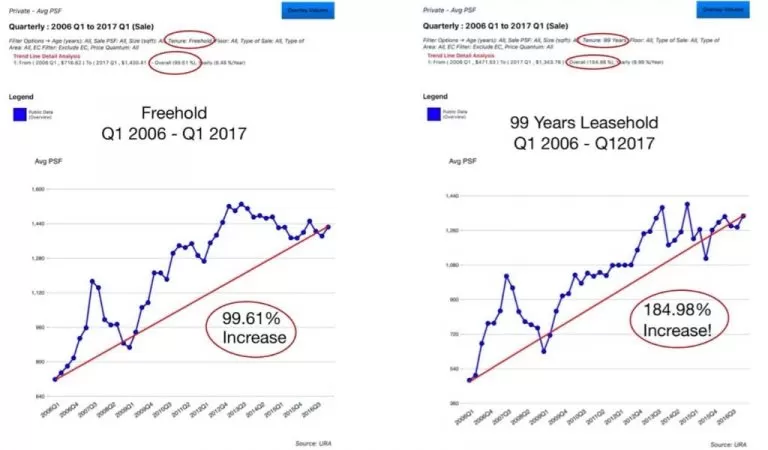

To drive home this point further, take a look at the graph above comparing the average per sqft value of freehold properties with that of 99-years leasehold properties from Q1 2006 to Q1 2017. Both types of properties experience an upward trend, but 99-year leasehold properties see a whopping 184.98% increase as compared to the 99.61% increase that freehold properties saw.

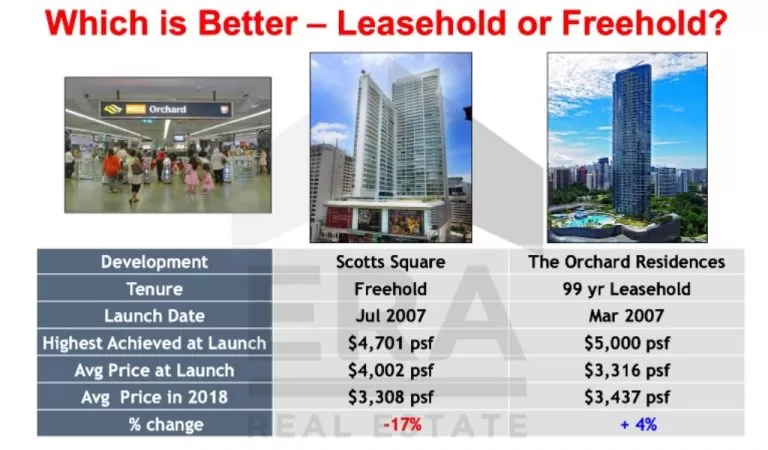

Similarly, comparing freehold Scotts Square with 99-year leasehold The Orchard Residences, we see that the latter saw a 4% increase as compared to Scotts Square which actually saw a 17% decrease in average per sqft price from 2007 to 2018.

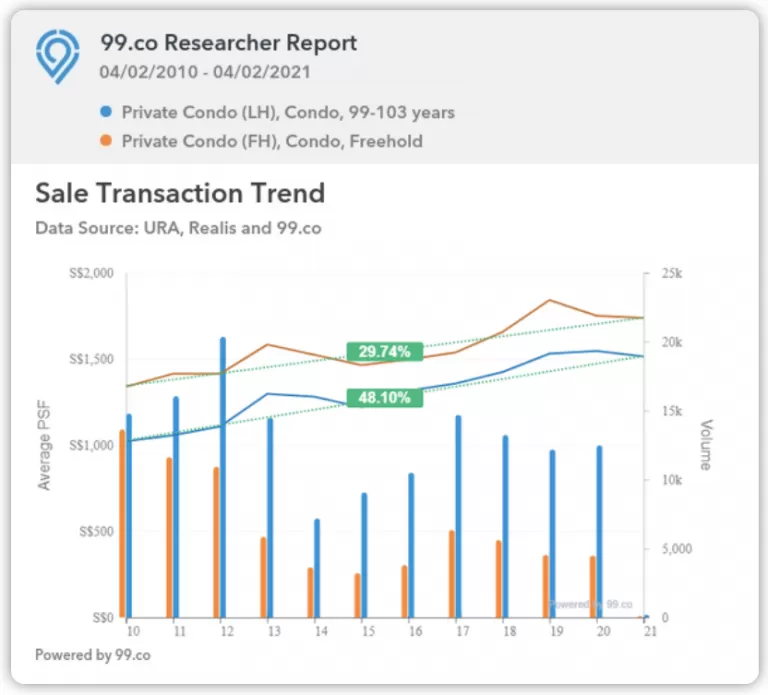

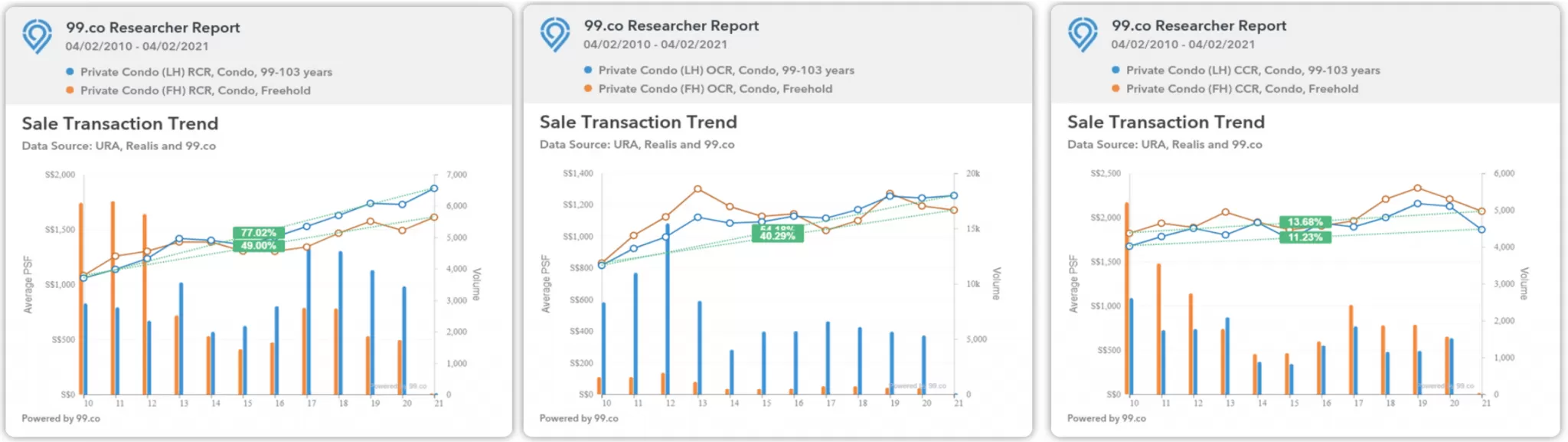

The same results are emulated in more recent years. From the graph below, an overall comparison between leasehold and freehold private condos from 2010 to 2021 shows that compared to leasehold condos (48.1%), freehold condos appreciated less (29.74%).

Case Study

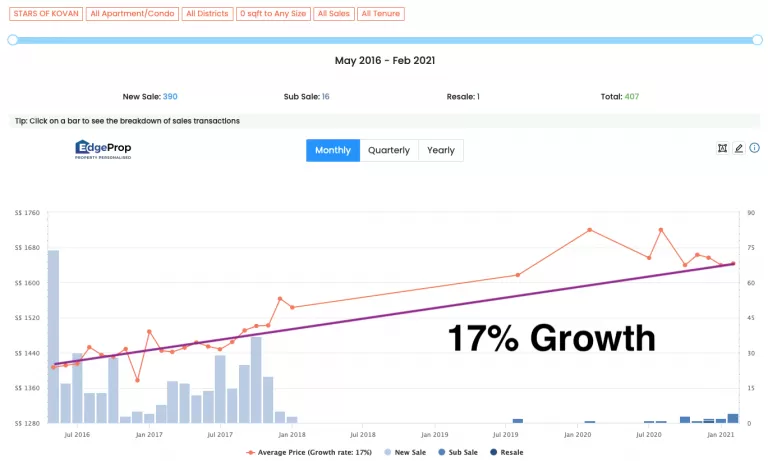

Another example is Stars at Kovan, a 99 Leasehold property vs Tembusu, a freehold property. This would be the best example as both of this condo is relatively launched roughly around the same time and it side by side. Both are within 5 mins walk to Kovan MRT station and both have roughly the same number of population. Let’s look at the data.

In 2016, Stars at Kovan is selling for around $1,400 psf whereas Tembusu is selling for around $1,500 psf.

There are 2 conclusion that we can draw from the graph above.

- 99 Leasehold condo, given a shorter period of time, manage to grow 17% whereas freehold condo manage to grow only 3%. This makes a difference of 5 times and potentially your profit is 5 times difference!

- There is less fluctuations for the 99 leasehold as compared to the freehold.

Comparison in different regions of Singapore

If we dive deep to look at properties in certain regions of Singapore, the same results are observed: leasehold properties outperformed freehold in Rest of Central Region (RCR) and Outside of Central Region (OCR).

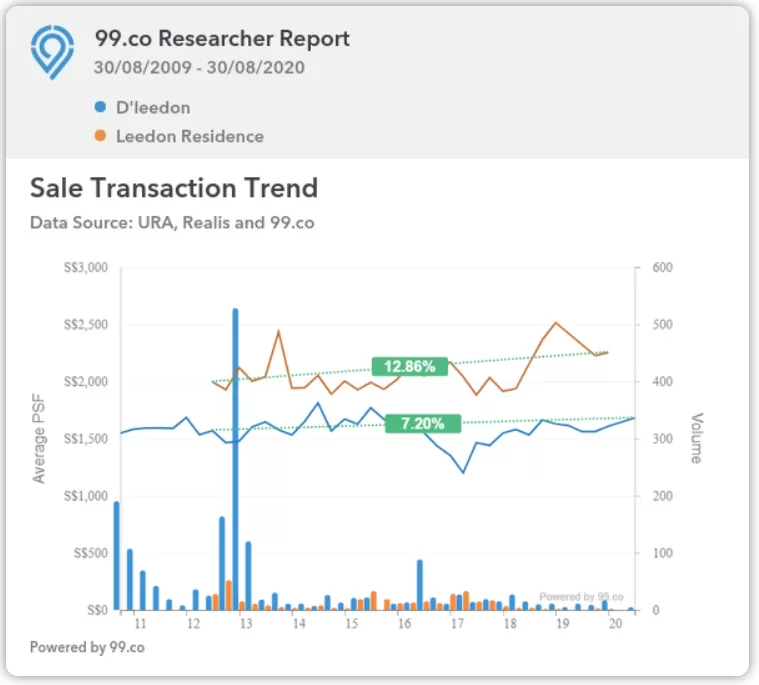

That said, when you hear of people saying that freehold properties fetch greater values than leasehold properties, it doesn’t mean that they are lying. Take a look at the comparison between freehold Leedon Residence and D’leedon, a 99-year leasehold property that is just opposite Leedon Residence.

That said, when you hear of people saying that freehold properties fetch greater values than leasehold properties, it doesn’t mean that they are lying. Take a look at the comparison between freehold Leedon Residence and D’leedon, a 99-year leasehold property that is just opposite Leedon Residence.

From 2009 to 2020, freehold Leedon Residence actually saw a 12.86% appreciation as compared to its leasehold counterpart which only saw 7.2% capital gain.

The truth is, lease status does not actually make much of a difference until a significant amount of time has lapsed. Leasehold properties enjoy appreciation like freehold properties when they are relatively new.

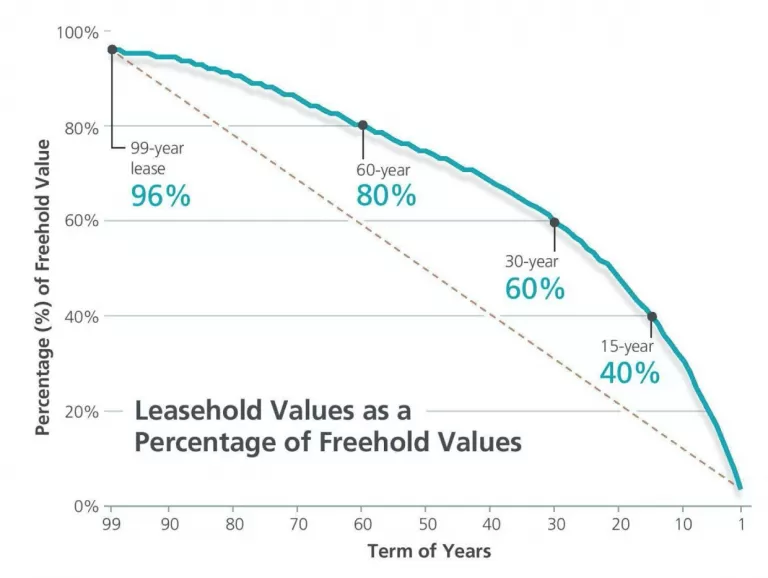

As seen from the above graph which shows the value of leasehold property as a percentage of its freehold value, it is observed that the value of a lease declines more sharply towards the end of the lease. Within the first 10 to 15 years, lease tenure makes close to no difference. Leasehold units only tend to show greater depreciation than leasehold properties at the 40 year mark.

Taken together, what this means is that even though freehold properties typically cost more that leasehold properties, the cost does not automatically translate to value. Leasehold properties tend to have more room for value appreciation because of its lower entry price and as a result, freehold properties actually appreciated less than leasehold properties in many circumstances.

Freehold vs leasehold: Rental yield

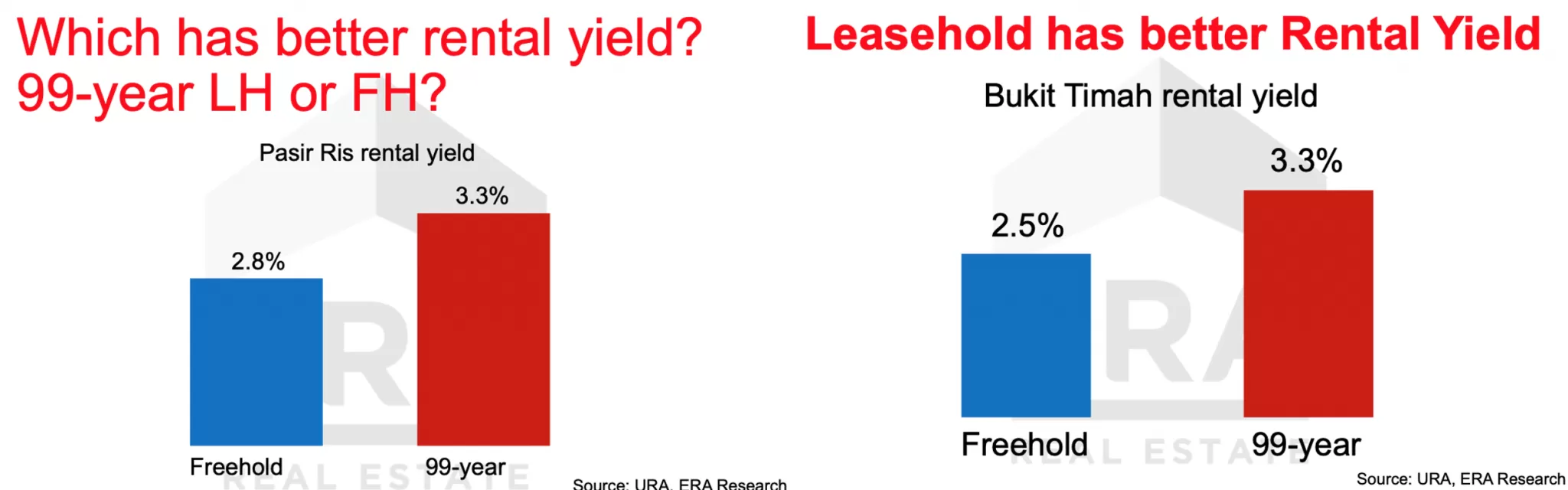

For the uninitiated, rental yield refers to the annual rental income divided by the total cost of the property. Therefore, the lower the cost, the higher the rental yield. As we’ve seen earlier, freehold properties typically cost more than leasehold properties due to its scarcity. And for that reason, leasehold units can be better for rental yields.

When you rent a house, do you care if it is a freehold property or a leasehold property? Your answer would probably be no. That’s because rental income will not be affected by whether a condo is freehold or leasehold. A tenant will not pay any less just because a condo is on a 99-year lease or pay more when the property is freehold.

Imagine you bought a leasehold property for $1 million and you earn $3000 each month from rental. Your rental yield would be 3.6%. In comparison, if you bought a freehold property in the same area at $1,150,000 (15% more), your rental income stays at $3000 each month, your rental yield would be 3.1%.

If we zoom in on real life examples, in Pasir Ris, rental yield for freehold property is 2.8% as compared to the 3.3% for 99-year leasehold property. Similarly, in Bukit Timah, freehold properties outperform 99-year leasehold properties in terms of rental yield.

For this reason, landlords in Singapore tend to find leasehold properties more attractive with its lower cost and higher rental yield. So if you are looking to invest in Singapore property, you may want to opt for a leasehold condominium for better rental yield.

The rental market does not differentiate between the types of tenure of the property. Leasehold properties have higher rental yields over comparable freehold properties, owing to their discounted prices. The higher yields serve to compensate for their depreciating tenure, higher risks and shorter lifespan to recoup the owner’s capital outlay.

Freehold vs leasehold: Reaping the rewards of en bloc

In theory, the en bloc value of a freehold property should be higher than a leasehold property because freehold property owners are giving up more during an en bloc. In addition, a leasehold unit near the end of its lease should be priced lower, because owners could end up getting nothing from it in a few decades. Because of this age-old theory, many Singaporeans gravitate towards freehold properties for a higher potential of reaping greater rewards during an en bloc attempt.

But as we already know, things don’t always work out in the same way theories predict. For example, zoning laws can prevent a freehold construction from being replaced by a condo of the same height, the en-bloc price may be cheaper despite the fact that the condo is freehold.

Developers also consider adjacent facilities, such as the building of railway stations, shops, and schools, when making an en-bloc offer. If the facilities surrounding a freehold property is run down and doesn’t improve or upgrade over years, en bloc price can still be lower.

Therefore, because en bloc offers are influenced by many factors such as the state of the economy, zoning laws, and the amenities that are nearby, leasehold projects can also reap great rewards during en bloc attempts. And this has happened: in 2007, Farrer Court, a 99-year leasehold, was sold for a whopping $1.34 billion. Each resident took home more than $2 million. This is currently the highest amount paid for a collective sale.

A logistic regression analysis shows that tenure is not a statistically signicant variable at the 5% level in determining the success of an en-bloc sale. It is, however, an economically signicant variable with a large coefficient.

Freehold vs leasehold: Loan restrictions

To finance your property purchase, you’d likely want to take out a loan. 99-year leasehold property buyers will face more housing loan and CPF usage restrictions. If the remaining lease does not last you till you are 95 years old, you will not be able to get a full loan from the bank and from HDB. You will also not be able to use your CPF to pay for the property up to its valuation limit.

Furthermore, if the remaining lease is less than 20 years, no CPF can be used to finance the property. This means that you may have to be prepared to fork out some money upfront when buying a 99-year leasehold property. It also means that resale prices of leasehold properties that are over 40 years into their lease would see lower resale prices.

Finally, the risk of owning a leasehold property becomes signicant as the remainder lease runs low. To finance a property using the Central Provident Fund (CPF), the sum of the remaining lease and the age of the buyer must be at least 80 years. For properties with remaining leases of between 30 and 60 years, a valuation limit will apply on the amount of CPF contribution that can be used to finance the property. The financing restriction would shrink the pool of potential buyers for ageing leasehold properties.

Freehold vs leasehold: Legacy planning

If you plan to buy a property to hold on to so that you can pass it on to generations to come, a freehold property is a much better choice for you. This is why older home buyers tend to favour freehold properties because they view it as a long-term asset that they wish to pass down to their children and grandchildren.

Certain foreign nationalities show a preference for freehold properties. Between January 2016 and August 2017, 71% of transactions were for leasehold properties and 29% for freehold ones. The proportion of freehold transactions, however, was higher among several key foreign purchasers, namely those from Indonesia (40%), the US (41%), the UK (50%), Australia (50%) and Hong Kong (34%). Interestingly, freehold properties accounted for 60% of purchases by companies. However, foreign buyers will prefer to buy in certain district like 9,10,11 and these are the districts I would recommend to go for freehold rather than leasehold.

Article from Straits Times

Here is an editorial article from the Straits Times Singapore by Leslie Yee.

Tuesday 29 June 2021, The Business Times, Page 13, Section: Real Estate

The bottom-line

The belief that buying a freehold property is always the better choice is misleading and a pure misconception. As we’ve seen, the advantages of freehold is more theoretical than practical. Leasehold properties can (and do) outperform freehold properties in terms of capital gain, rental yield, collective en bloc offer amounts, all while costing less than freehold properties. Unless you are set on legacy planning, leasehold properties seem to be the better choice.

Of course, there are many factors to consider when investing in a 99-year leasehold. To name a few, you should take note of entry price, lead time, the age of the property, and very importantly, your exit strategy. Moreover, lease is just one factor: examining the characteristics and differences between specific developments is important too.

In Summary, this entire article can be summarise in just 1 side.

If looking at maximum gain with a holding period of less than 12 years, go for a leasehold property. For legacy planning for holding more than 15 years, go for freehold property.

If you’re still stuck in a rut and can’t decide which is for you, feel free to contact us. We provide consultancy services and bespoke solutions to your buying, selling, investing and renting of Singapore luxury condominiums. We also manage personal financial advisory services and property portfolios connecting you to the best properties in Singapore.