What Makes A Fundamental Strong Property in Singapore

We all want to know the essentials of a “strong” property here in Singapore. To begin with, let’s understand what exactly is a strong fundamental property, and how it can benefit you. This term is for properties that never lose money and continue to guarantee profit for investors, regardless of the market cycle. Such properties are known for their strong or high demand or have something unique that people sought after.

Essentially, if you want to gain the most benefits from investing in properties, a fundamentally strong property should be your go-to. So, how do you know if a property is fundamentally strong or will remain in high demand and profit over time? To answer these questions, we will look into the factors that make a strong fundamental property.

#1: Understanding buyer’s persona

To fully comprehend what makes a strong fundamental property, we have to understand from the buyer’s perspective. After all, what makes a property in high demand and lucrative is buyers’ needs and willingness to pay. While there are many kinds of buyers, they generally come down to two major types. The first type of clients is those who invest in houses. The other type of buyers are people who purchase properties for their own stay.

If you are wondering how will understanding a buyer’s purposes can make a property fundamentally strong or how it can positively affect your profits, do not worry. Read on to see further elaboration and how you can best benefit from these factors.

1.1 Buyer’s persona: for investments

This group of buyers focuses on investing in the most profitable properties. As investors, they compare several developments and find the property which offers the highest rental yield at the best possible price. Essentially, fundamentally strong properties are the most profitable houses that such buyers will choose for investment.

Now that you know investors’ preferences, how can you benefit from this? It is simple. Offer high rental yield with a low price tag. That will make your property a strong fundamental investment property and attract more such buyers for investment purposes.

1.2 Buyer’s persona: for own stay

This type of client prioritises their own stay needs. What does this mean? Simply put, they are only willing to pay a higher price for a property that they feel have the things they require. One easier way to understand the “things” such buyers need is to focus on the characteristics of such strong fundamental investment properties. Mainly, there are eight characteristics which would be explained in the next part.

#2: What are the characteristics?

2.1 Location

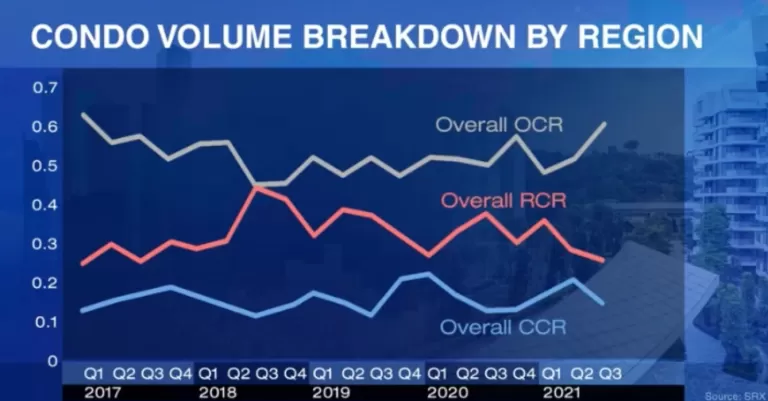

If you feel that the location of your house is one of the most important factors, you are not alone. Most buyers focus on the location of properties. In particular, properties at the Rest of the Central Region (RCR) and outside the central region (OCR) in Singapore tend to be more affordable. You may also know RCR as city fringes close to town and OCR as the outskirt of the city.

While strong fundamental properties in OCR and RCR tend to be less expensive, specific unit sizes are still preferred. For developments in the city fringes or RCR, a two-bedroom unit (2BR) is higher in demand. On the other hand, a three-bedroom unit (3NR) is preferred in OCR. In fact, you can say that these are the most preferred unit sizes currently in Singapore.

2.2 Accessibility

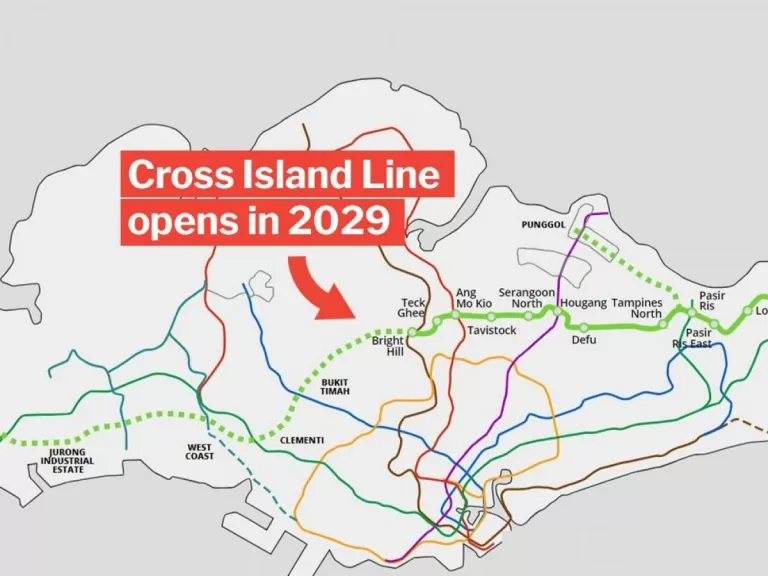

Another characteristic of strong fundamental properties is accessibility. One simple way to remember this factor is to ask yourself: Would you prefer to live nearer or further from the MRT? Unsurprisingly, most people will favour a property within walking distance from the MRT. In fact, for it to be considered as “walking distance”, it must be a maximum of 800m between the house and MRT. Essentially, if you take any longer than 8 minutes to walk to the MRT from the property, you will feel that the property is too far away and not as accessible. And did you know? For RCR developments, this factor of distance to MRT becomes especially important! Continue in the link here for “The MRT Effect: How MRT Stations Affect Property Prices“.

While the 800m or 8-minute walk rule is recommended, it is not entirely necessary for certain developments. Properties exempted from that rule would be those further from the city centre. And why is this so? This is because these houses tend to be cheaper, and buyers will more likely already own a car. Basically, the distance to MRT no longer becomes a priority.

Apart from the accessibility to MRTs, the accessibility to primary schools is also equally important. In fact, this rule is especially important for properties in the OCR. What should you ensure then? That the property has to be near as many primary schools as possible. Preferably, the estate also has to be within 1km from the primary school! That is because it will give the child priority to enter that primary school. After all, Singaporean parents are known to be competitive over securing a spot for their children in the primary school registration exercise. Hence, it is not surprising that buyers are willing to pay more for properties closer to primary schools. Remember that more primary schools within distance mean more choices for buyers. And that means the property will be in higher demand and bring better profits!

2.3 Developer reputation

A developer reputation is another characteristic of a strong fundamental property. Why? The reason is simple. Buyers prefer properties that have better quality finishing and workmanship. And a reputable developer that has a reputation to protect can consistently deliver that. As a matter of fact, reputable developers will go beyond just the interior of a house. They will ensure that the exterior and facilities of the property will have the same great quality too! For instance, you can take a look at the projects done by one of the major developers, CDL. CDL projects are known for their top-notch workmanship, and they continue to look brand-new even after ten years. On the contrary, developers with a poorer reputation may produce lower quality projects that end up looking extremely rundown after a mere five years. Hence, buyers will be more enticed in purchasing a house made by a trustworthy developer, as their home will seem fresher and long-lasting.

2.4 Range of units

Did you know that the houses between the 5th to 15th floor tend to be the most profitable? This is after looking through hundreds of condo units, sorting out all the PSF prices from the lowest to the highest, and choosing between the 25-55 percentile. To summarise, I have found that this estimated range can give you the optimum highest profit margin.

2.5 Size of developments

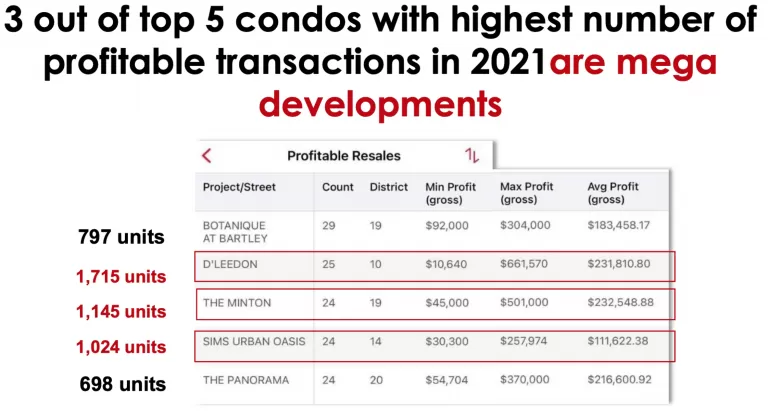

If you are looking for fundamentally strong properties, here is a tip. Do not choose boutique developments of less than 200 units. Simply put, there is not enough transaction volume for such small developments, hence making it extremely hard for their value to increase. Instead, I recommend mega developments of over a 1000 units for better profit margin. With so many units, it is more likely for units to change hands, and hence valuation can start to increase. Read more here for “A Study of Mega Developments in Singapore“.

Choosing a unit with a regularly shaped layout and minimal wasted space is equally important. We purchase homes to stay for the long term. Essentially, it means we love a good and functional house layout that allows us to efficiently use every single space in our homes. In addition, the regularly shaped property layout is critical for upgraders (that previously own HDB) as they are more used to such layouts commonly seen in HDBs. Hence, it allows them to cater to more of their needs and habits.

2.6 Maintenance fee

Another factor of a fundamentally strong property is a reasonable maintenance fee. From my past experiences, I can tell you that anything more than $400 of maintenance fees will turn off buyers from purchasing properties. That also aligns with my other point of small developments, as they tend to have a higher maintenance fee. To put it in perspective, imagine paying a $200 maintenance fee for over 200 units and a more costly $450 private maintenance fee for a single pool and small gym. Which do you prefer? If you still cannot decide, perhaps a mid-range development of 600 to 800 units would be the better choice for you then.

2.7 Correct price

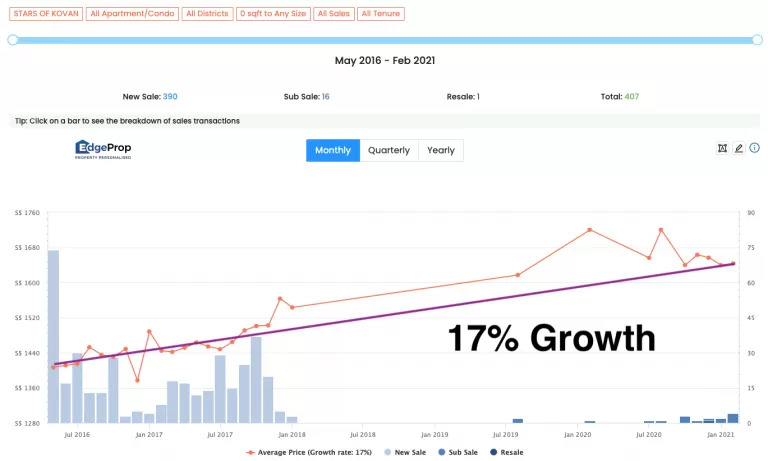

Ensuring that a property is correctly priced is also vital. For example, imagine you are interested in a particular development in the RCR region. What can you do to ensure it is optimally priced? You can do so in 3 simple parts. One: compare the property price with other developments nearby and in the rest of the RCR region. Two: research about the market in that district. And three: research and predict for any future growth for that area.

2.8 First mover advantage

Have you ever heard of the term “first mover advantage”? It means that there are more advantages when you take the first move – i.e. purchasing a project in the initial or early launch phase. For a more detailed explanation of the developer’s relationship with banks, you can check out my previous video and chapter on developer pricing strategy. But to summarise, it is the cheapest during the first few stages of the project, and developers will gradually increase project prices as they sell more. Essentially, you should snatch up the low-cost unit during the early phases for early break-even profit. You can just sit back and watch your condo appreciate pricing as it gets constructed! Read more in the link for 7 benefits of purchasing a new launch condo.

Finding a strong property in Singapore

Now that you understand the makings of a strong property in Singapore, it’s time for you to use your knowledge to generate profits for you. But remember, do your calculations and understand your financial situation before jumping into any decision!

If you are keen to know which developments in Singapore is considered a strong fundamental, feel free to contact us at Singapore Luxury Condo or the form below or check out top 6 developments that guarantee profit.