Investing in Real Estate: Condominiums for Sale in Singapore

Investing in Real Estate: Condominiums for Sale in Singapore

Investing in real estate can be a lucrative venture, providing individuals with a stable and potentially profitable asset. Singapore, known for its thriving economy and robust property market, offers a range of investment opportunities, particularly in the apartment sector. This article explores the benefits of investing in condominiums for sale in Singapore and provides valuable insights for potential investors.

Singapore's Thriving Real Estate Market:

Singapore’s real estate market has consistently demonstrated resilience and growth over the years. The city-state’s strategic location, strong infrastructure, political stability, and business-friendly environment make it an attractive destination for investors. The government’s effective urban planning has resulted in a well-designed cityscape with modern amenities, enhancing the appeal of the property market.

Advantages of Investing in condominiums:

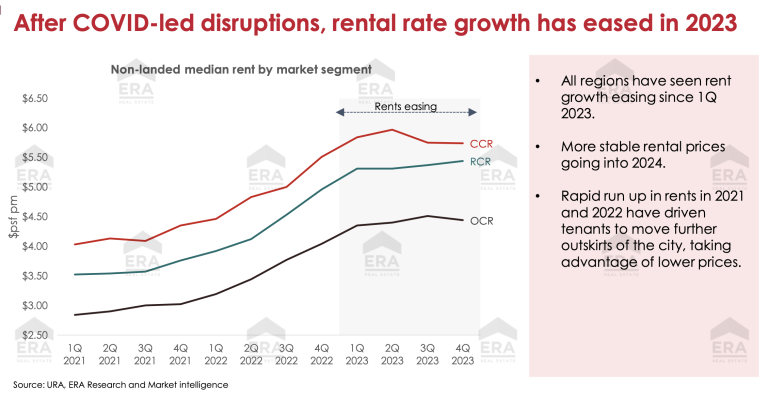

Investing in condominiums in Singapore offers several advantages for potential investors. Firstly, condominiums are highly sought after due to their convenient locations, modern amenities, and lifestyle appeal. They cater to a diverse range of tenants, including working professionals, expatriates, and families, ensuring a steady demand for rental properties.

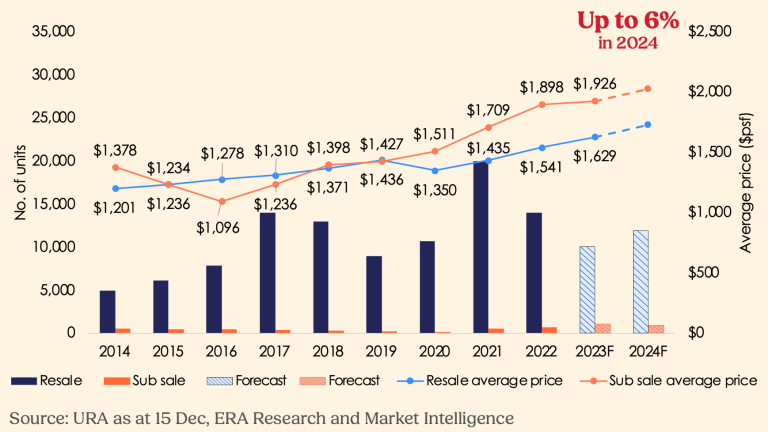

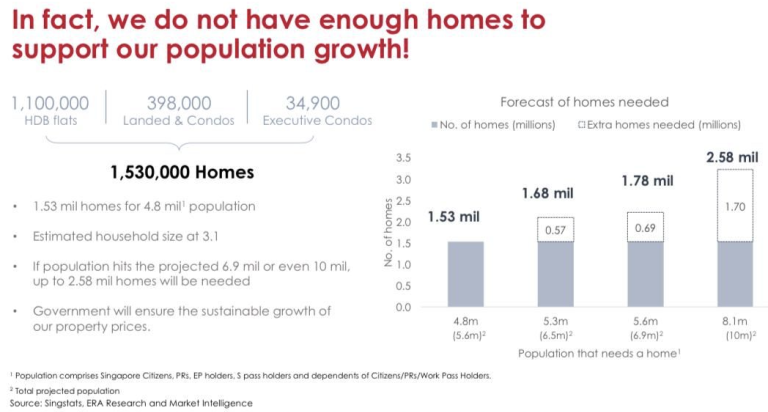

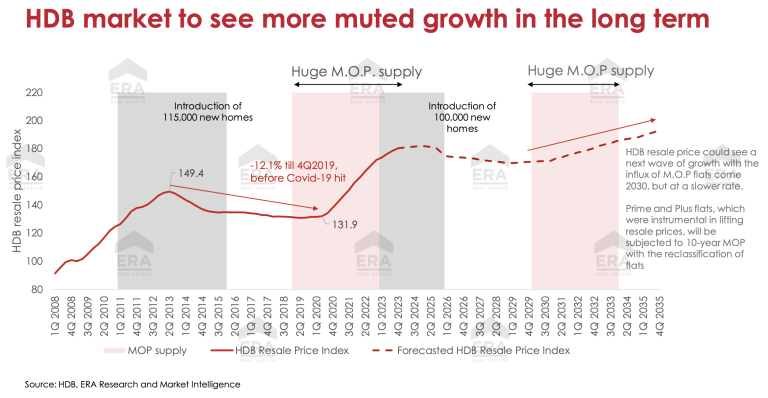

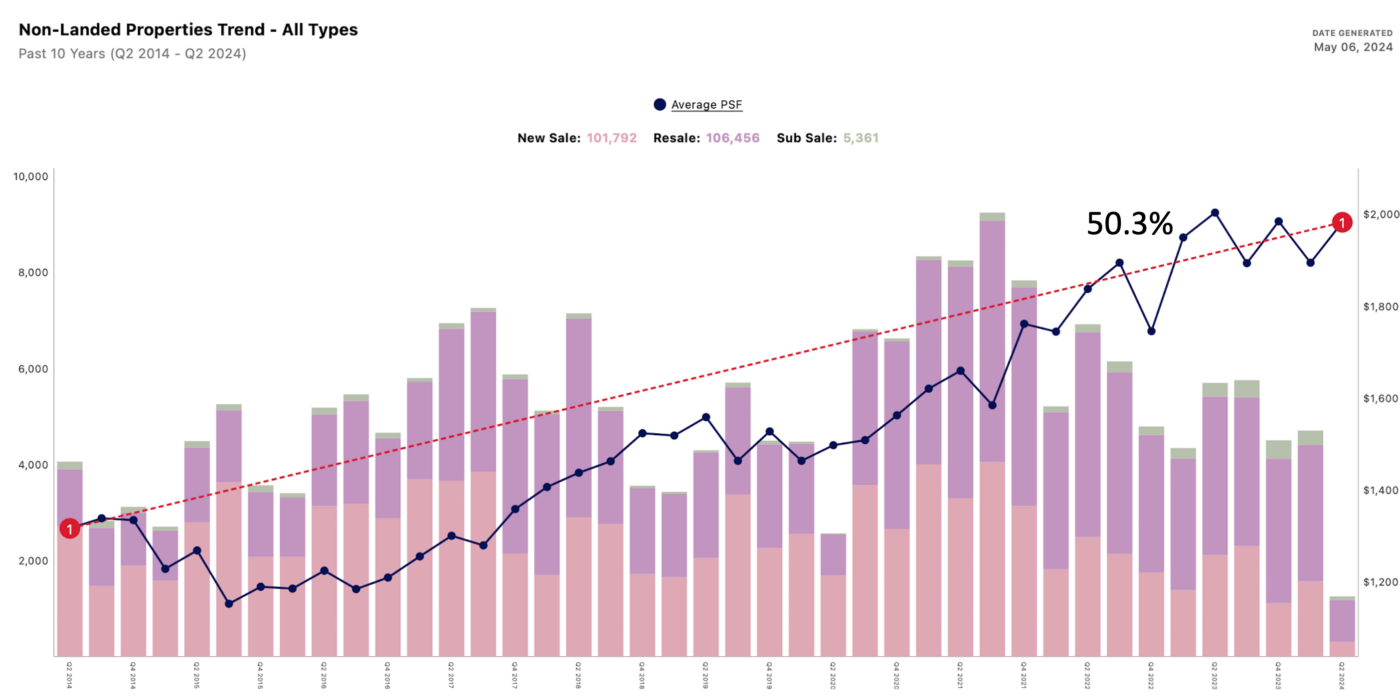

Additionally, condominiums often provide attractive rental yields and capital appreciation potential. The limited land supply in Singapore, coupled with the growing population and strong economy, contributes to the appreciation of property values over time. This makes condominiums a viable long-term investment option.

Prime Locations for Apartment Investments:

When considering apartment investments in Singapore, certain locations stand out as prime areas for potential investors. Districts such as Orchard Road, Marina Bay, and Sentosa offer prestigious addresses and high-end condominiums that appeal to affluent tenants. These areas are renowned for their vibrant lifestyle, proximity to business hubs, and world-class amenities.

For investors seeking more affordable options, emerging neighbourhoods like Jurong Lake District and Punggol present promising opportunities. These areas are undergoing significant development, with improved connectivity and upcoming infrastructure projects, making them attractive for long-term investments.

Factors to Consider Before Investing:

Before investing in condominiums for sale in Singapore, it is crucial to consider various factors to make informed decisions. Conduct thorough market research to understand current property trends, rental yields, and vacancy rates. Analyse the historical price performance and growth potential of the location to assess its investment viability.

Furthermore, evaluate the apartment’s condition, including its age, maintenance, and potential for renovation or refurbishment. Assess the surrounding amenities, such as schools, hospitals, transportation, and shopping centers, as these factors influence the property’s desirability and rental demand.

Financing Options for Apartment Investments:

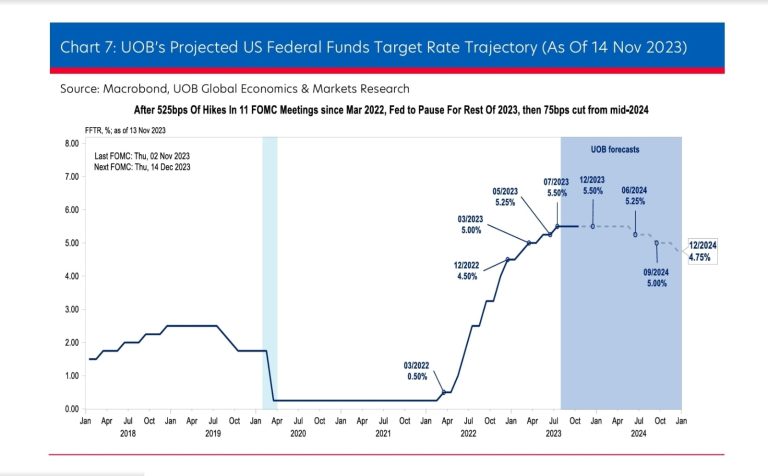

It takes a lot of money to buy a condo, but there are options for financing that can help buyers. Singapore’s financial institutions and banks offer mortgage loans with flexible repayment terms and competitive interest rates. Find reputable mortgage specialists to discuss your investment objectives and financial capabilities in order to select financing options.

It is prudent to look for pre-endorsement for a home loan before effectively looking for condos. This will enable a more focused property search and will clarify the budget.

Tips for Successful Apartment Investment:

To ensure a successful apartment investment, consider the following tips:

• ENGAGE A RELIABLE REAL ESTATE AGENT : Work with an experienced real estate agent who possesses in-depth knowledge of the local market and can guide you through the investment process.

• DUE DILIGENCE : Conduct thorough inspections, review legal documents, and seek professional advice to mitigate risks and make informed decisions.

• LONG – TERM PERSPECTIVE : View apartment investments as long-term assets that provide consistent returns over time, rather than short-term speculative investments.

• PROPERTY MANAGEMENT : Consider engaging a professional property management company to handle tenant screening, rent collection, and maintenance, ensuring a hassle-free investment experience.

• DIVERSIFICATION : Consider diversifying your investment portfolio by investing in multiple condominiums across different locations to spread risk and optimize returns.

Tax Implications and Regulations:

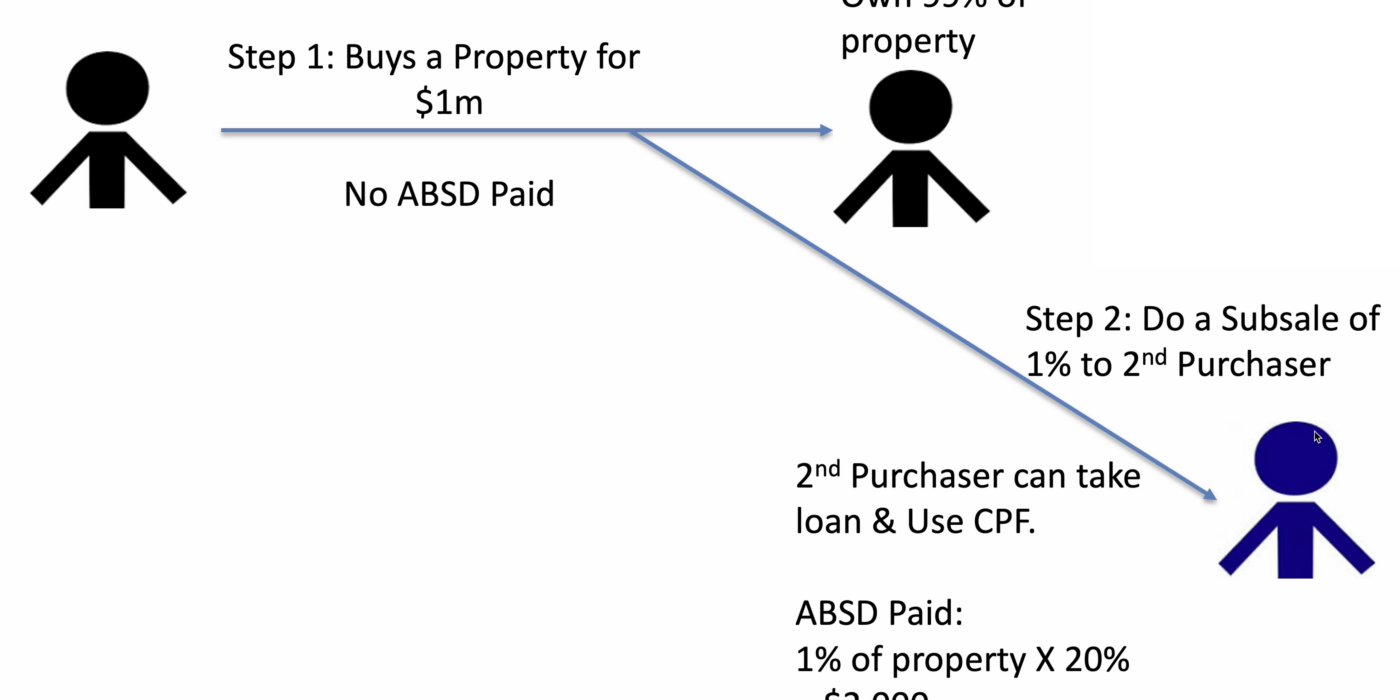

Investing in condominiums in Singapore entails certain tax implications and regulations. As an investor, you must be aware of the applicable stamp duties, property tax, and goods. Additionally, the Singapore government periodically introduces property cooling measures to manage the property market. Stay updated with the latest regulations to comply with legal requirements and avoid any penalties.

Risks and Challenges:

While there are many benefits to investing in condominiums for sale in Singapore, it is important to be aware of the risks and challenges. Property prices and rental demand can be affected by changes in economic policies, global market conditions, and other factors. To successfully navigate potential obstacles, conduct thorough risk assessments and consider consulting with financial advisors.

Investing in condominiums for sale in Singapore can be a rewarding venture for individuals seeking stable long-term returns. However, it is crucial to conduct thorough research, assess various factors, and stay updated with regulations to make informed investment decisions. Contact us today to know more luxurious condominiums in Singapore.