Freehold vs Mixed Development | Which is a Better Choice?

We will be comparing the difference between freehold condominium and mixed development or integrated development and determine which is a better choice. We will be looking at the profit growth and volume transactions of 4 examples, namely location in Beach Road, Redhill, Potong Pasir and Hillview.

Freehold Condominium

A freehold condominium is define as a property where the owner owns the unit and also purchased the land on which the condo sits on. This means that the owner owns the condo and the land.

In legal term, the estate is fee simple, where a person owns the land indefinitely, without conditions, and upon his or her death, the land passes onto his or her successors (or to his choosing via a Will); and life estate, where a person owns the land for the duration of his or her lifetime.

Mixed Development Condominium

A mixed development, usually a 99 leasehold condominium, not only have a residential component and usually have other additional components such as commercial malls, f&b, commercial spaces, offices, etc.

Mixed development are usually highly sought after as they are usually linked directly or access to a MRT / train station which gives the residences very good accessibility.

Case Studies

Below are 4 case studies by comparing a mixed development vs a freehold development that is close by.

In selecting the best 4 case studies as a comparison, here are the five perimeters that I have selected in order to select the best four choices.

- Mixed developments chosen are all 99 leasehold properties

- Freehold and mixed development and around the same size and are mid range condominiums

- Both developments are roughly around the same age.

- The two developments are around the same size.

- Both of them are as close as possible to each other.

Beach Road

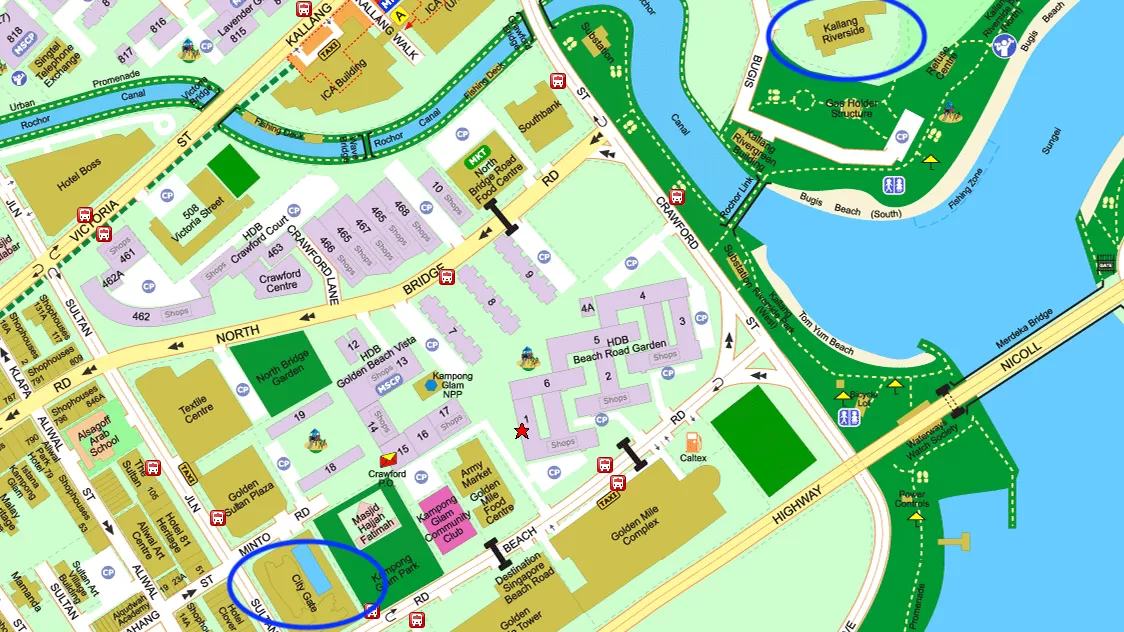

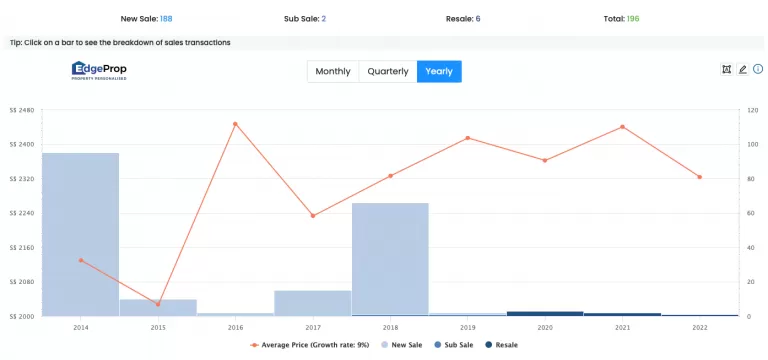

In my first example, let us look at City Gate, a mixed development in Beach Road with retail mall and direct access to Nicoll Highway MRT station vs Kallang Riverside, a freehold development nearby.

This 2 developments are exactly similar in number of residences and the age of the condominiums, hence this is one of the best possible comparison. Looking at the above two data, I sum up the research in the table below.

| City Gate (Mixed Development) | Kallang Riverside (Freehold Development) |

|---|---|

| $1,845 psf (2014) | $2,129 psf (2014) |

| $1,971 psf (2022) | $2,323 psf (2022) |

| 7% Annual Growth Rate | 9% Annual Growth Rate |

| Vol Transaction (2yrs): 19 | Vol Transaction (2yrs): 5 |

Redhill

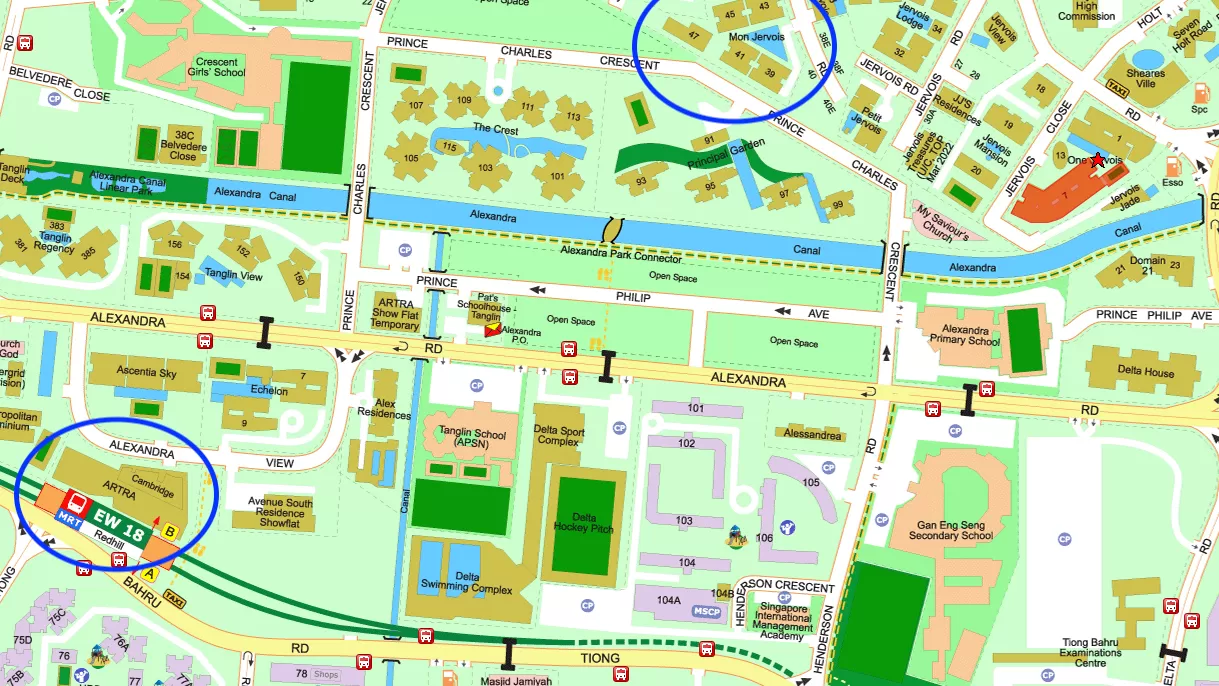

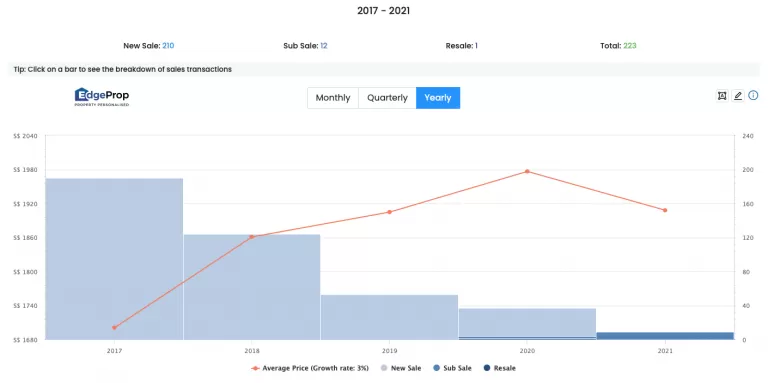

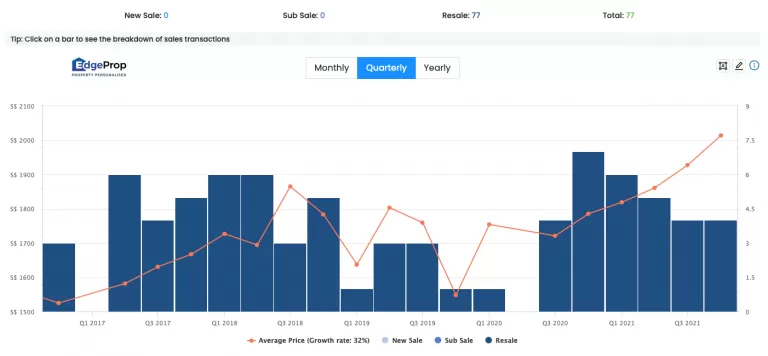

In our second example, let’s look at Redhill, where we will compare Artra, a new 99 leasehold mixed development and One Jervois, a freehold development.

In our second example, let’s look at Redhill, where we will compare Artra, a new 99 leasehold mixed development and One Jervois, a freehold development.

| Artra (Mixed Development) | One Jervois (Freehold Development) |

|---|---|

| $1,653 psf (2017) | $1,525 psf (2017) |

| $2,013 psf (2022) | $2,014 psf (2022) |

| 3% Annual Growth Rate | 32% Annual Growth Rate |

| Vol Transaction (2yrs): 12 | Vol Transaction (2yrs): 31 |

You can see clearly that One Jervois, a freehold development has a much higher growth potential as compared to Artra. However, also do take note that the volume transaction is also a lot higher as compared to Artra.

Potong Pasir

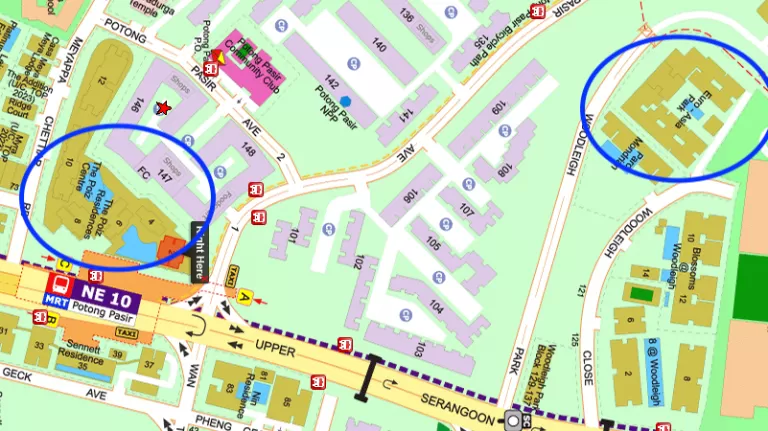

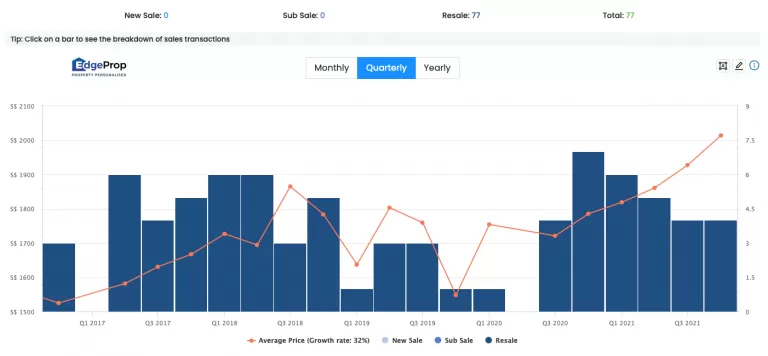

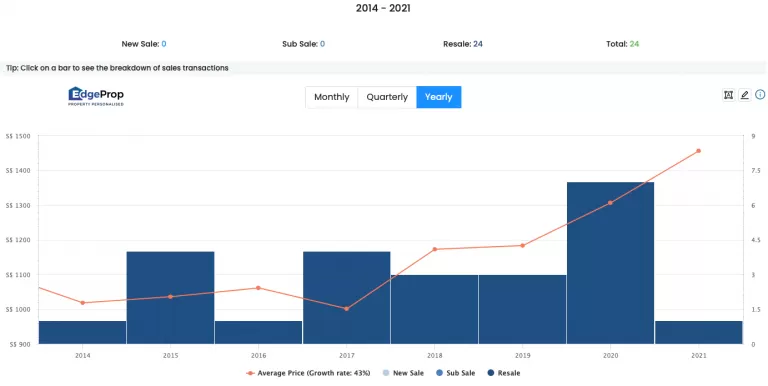

For the third example, we will look into Potong Pasir. Poiz Residences is located next to the MRT station and is a mixed development. Euro-Asia Park is a freehold development further away from the MRT station.

The summary of the price trend, growth and volume transaction is given in the table below.

| Poiz Residence (Mixed Development) | Euro-Asia Park (Freehold Development) |

|---|---|

| $1,423 psf (2015) | $1,036 psf (2015) |

| $1,770 psf (2022) | $1,456 psf (2022) |

| 24% Annual Growth Rate | 43% Annual Growth Rate |

| Vol Transaction (2yrs): 78 | Vol Transaction (2yrs): 8 |

The data above also follows the rest of the other examples. Mixed development has a lower growth potential as compared to a freehold development. Also, the demand of Euro-Asia Park is very much less of only 8 units transacted as compared to Poiz Residence which has a total transactions of 78 in the past 2 years!

Hillview

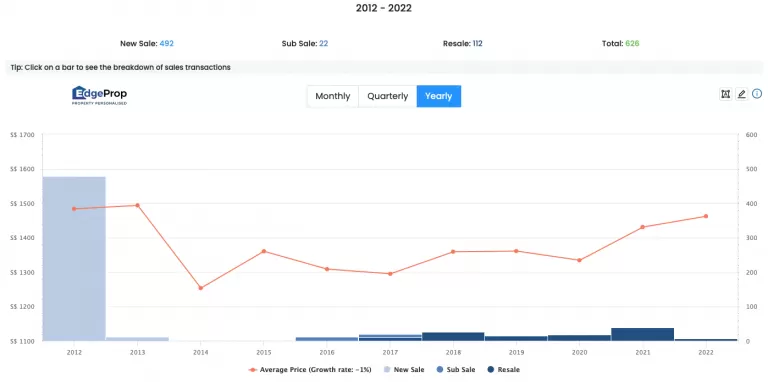

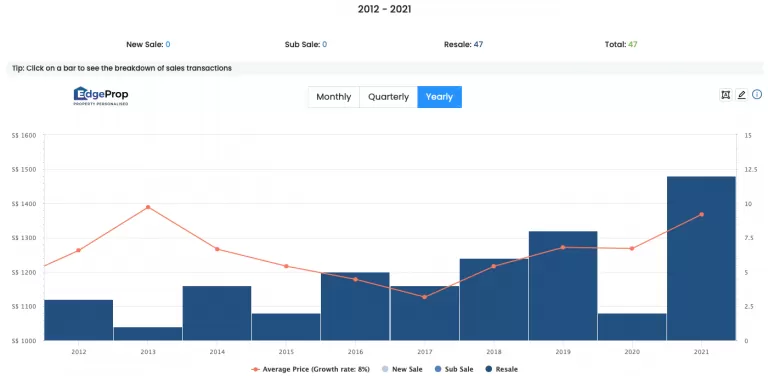

In the last example, we will look at 2 condominiums slightly further away from the city. Hillier is a mixed development that is closer to the MRT as compared to Hillvista which is further away from the MRT station yet is a freehold development. We will look at the trend from 2012 til 2022.

Again, I will summarise the data from above to the table below, looking at the price trend and the volume transactions over the last two years.

| Hillier (Mixed Development) | Hillvista (Freehold Development) |

|---|---|

| $1,483 psf (2012) | $1,263 psf (2012) |

| $1,462 psf (2022) | $1,368 psf (2022) |

| -1% Annual Growth Rate | 8% Annual Growth Rate |

| Vol Transaction (2yrs): 56 | Vol Transaction (2yrs): 20 |

Similar to the other three case studies, you can clearly see that the freehold development has a better return of investment as compared to the mixed development. Interestingly, over the past 10 years, the Hillier in fact drop by 1%! However, the volume transaction of the freehold Hillvista is more than double as compared to the mixed development.

Summary of the 4 Case Studies

| Beach Road | Redhill | Potong Pasir | Hillview | |

|---|---|---|---|---|

| 99 LH | 7% | 3% | 24% | -1% |

| Freehold | 9% | 32% | 43% | 8% |

| Vol Trans (99LH) | 19 | 12 | 78 | 56 |

| Vol Trans (FH) | 5 | 31 | 8 | 14 |

Looking at the four case studies, we can clearly see four trends.

- Freehold development earn more than a 99 leasehold development.

- The difference in profit will be wider if the holding period is longer. Hence, the longer you hold a freehold, the greater the profit.

- However, freehold developments usually have a much lower transaction volume.

- Distance to MRT station is not that of a significance when comes to investing. In fact, if a property is further, the price is lower and hence easier entry price.

However, do note that for One Jervois, it is an outlier data. The demand for freehold is close to 3 times that of a 99 leasehold Artra. This can be explain in two reasons. Location for freehold is important, places close to the Core Centre Region generally has a higher demand for freehold properties. People buying into these location usually are of a higher income bracket and hence affordability is not an issue. Status and legacy planning is more important.

Secondly, if you look at the price, you can see that although the freehold is further from MRT station, the freehold development price in 2022 is $1,456 psf as compared to $1,770 psf of the mixed development.

Although the psf is lower, also do take note that the sizes of One Jervois is much bigger, hence over quantum of the unit may be $500k – $1m higher! As previously stated, Redhill is close to the Core Central Region hence the buyers are more affluent and able to afford a higher quantum property with a much larger space.

My Personal Opinion

My personal overall general recommendation is if you are going for something short term, look at a mixed development. If you are looking for long term of more than twelve years, go for a freehold condominium.

My Property P.L.U.S System analyse this four component in a property for investment; Price, Location, URA Masterplan, Saleability.

Although the above is just a generic recommendation, you also have to ask yourself the following questions,

- what is your entry strategy?

- if you are looking at 2 condominiums, given a $300 psf profit 3-5 years down the road, which make more sense?

- Who is the profit of your future buyers?

- What amenities are highly sought after in your development of your condominium surrounding?

- What is the top 3 reason why a buyer would pay premium for your location or your unit?

- Can they afford the bank mortgage?

- Does the cost justify the convenience?

Also understand that not all units are created equally. Every investor or homebuyer are looking for something different. Homeowners have different objectives and plan. Some look for higher profit while others look for convenience. Moreover, the comparison above is also too generic in a sense that I only look at the macro picture and not the micro. Eg, I did not look at 1-2 Bedrooms vs 3-4 Bedrooms. The data will be different.

To really do an in-depth study, I would ask the following questions to my clients;

- What size, layout, facing, price are you looking at?

- How you use our investment calculation tools / formulas to do your calculation?

- What is your overall objective? Safe investment? Highest possible return? Easy to liquidate?

- If I recommend one that gives good return and also a safe investment and easy to liquidate, does it suits your own stay needs?

- What entry price are you entering into and is that a good entry price?

- What is your overall exit strategy?

I’ll leave you with my next good research: Freehold vs leasehold Properties: Which is for you?