A Study of Mega Developments in Singapore: Is it worth investing?

Over the years that I’ve been doing what I’m doing, several of my clients have asked me this one question: “Should I purchase a unit in a mega development?” It’s a great question—because there are several valid concerns surrounding the decision to purchase a unit in a mega development.

If you’re like these clients of mine, you wouldn’t want to miss out on this post. Today, we’ll dive deep into a study of mega developments in Singapore. We’ll first look at what exactly are mega developments as well as the pros and cons of purchasing a unit in a mega development. Let’s get started!

What exactly is a mega development?

Put simply, mega developments are condominiums with a total number of more than 1,000 units. Units typically range from 1 to 5 bedrooms, and the condominium would usually be packed with multiple facilities such as tennis courts, pools, gyms, playgrounds, BBQ pits, and more.

To put things into perspective, some examples of mega developments in Singapore are Parc Clematis, Treasure @ Tampines, Affinity @ Serangoon, and Normanton Park.

Why you should invest in mega developments?

Now that we know what mega developments are, you may be wondering why you should invest in mega developments. Here, I’ll share with you four reasons why you should consider purchasing a unit in a mega development.

1. Rental Yield

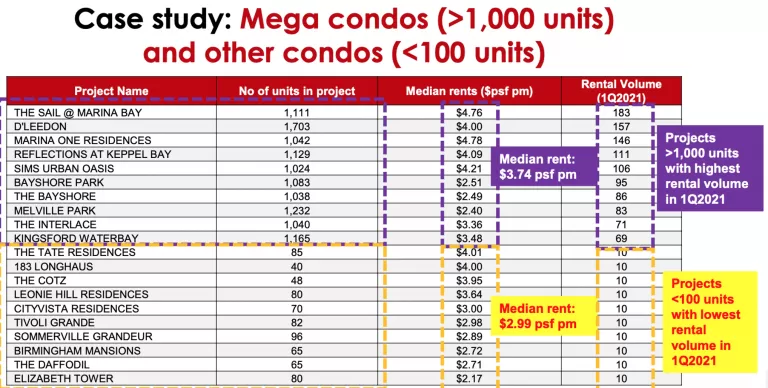

Take a look at the comparison between mega condos and other condos in terms of rental volume. These condos are situated within similar districts, so as to ensure a fair comparison. As you can see, the median rent for mega developments is roughly $3.74 psf pm. On the other hand, the median rent for smaller condos is about $2.99 psf pm.

This higher rental yield of mega developments can be attributed to the attractiveness that the abundance of facilities accords to the condominium. People love wonderful amenities like poos and Jacuzzis; they’d be willing to fork out a larger some of money in order to rent a place that allows them to enjoy these facilities.

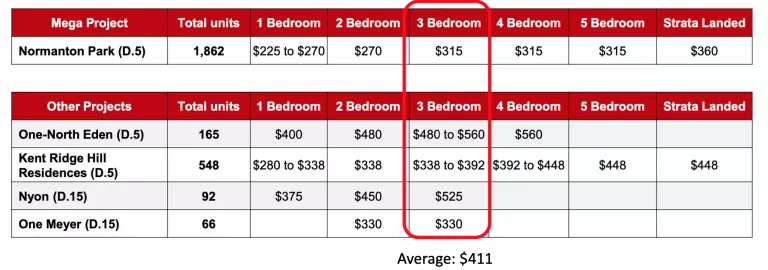

In addition, because more families are sharing the overall cost of the maintenance fees that condominium buyers need to pay, the maintenance fee that each family pays in mega developments will be lower, as seen in the table below. In District 5 and District 15, newer and smaller projects like One-North Eden, Kent Ridge Hill Residences, and Nyon have higher maintenance fees as compared to mega project Normanton Park. Here, One Meyer is the outlier as it lacks facilities. Even so, its maintenance fees are higher than Normanton Park.

2. Return of Investment

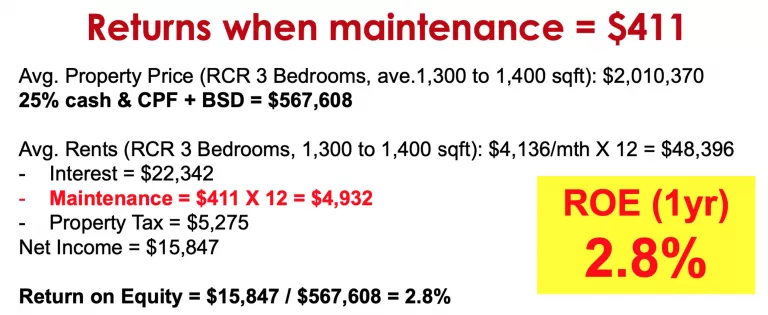

From the previous point, smaller condominiums have higher maintenance fee. From the table above, you’d have to pay an average of $411. Taking this average, let’s look at the difference in the return of investment when you purchase a unit in a mega development as compared to when you purchase one from other projects.

Return of investment refer to your total profit, divided by the total cash that you forked out. In the case when you purchase non-mega development properties, return of investment per year would be about 2.8 %, when costs, interest rates, and property taxes are taken into account.

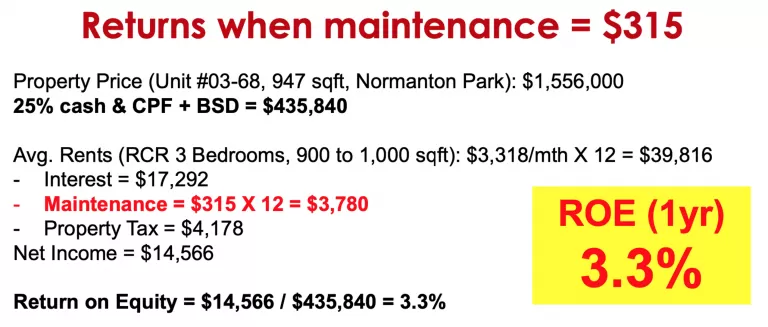

Now, let’s look at mega developments, with a $315 maintenance fee. With the same calculation method, we get:

As seen from above, your return of investment yearly would be 3.3% when you purchase a unit in a mega development. Clearly, in terms of return of investment, mega developments are the way to go.

3. Capital Appreciation & Protection

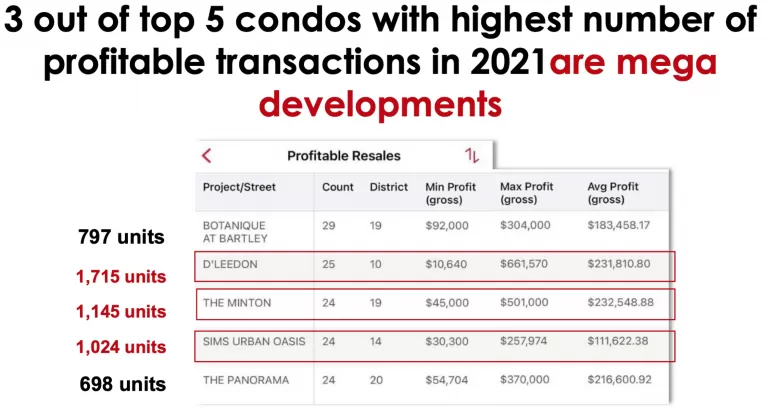

From my own research, I found that 3 (D’Leedon, The Minton, Sims Urban Oasis) out of 5 condos with the highest number of profitable transactions in 2021 are actually mega developments, as seen from the table above.

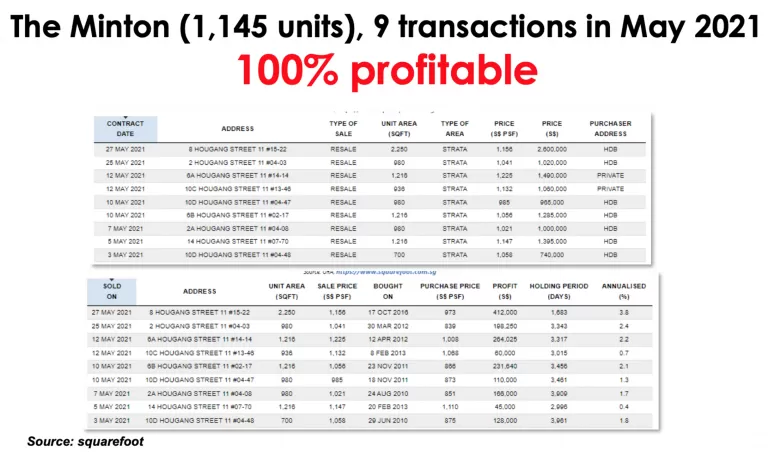

Let’s dive deep into The Minton as a case study. The Minton is situated at Upper Paya Lebar, and is a mega development with 1,145 units in total. In May 2021, there were 9 transactions and all 9 made a 100% profit, listed below.

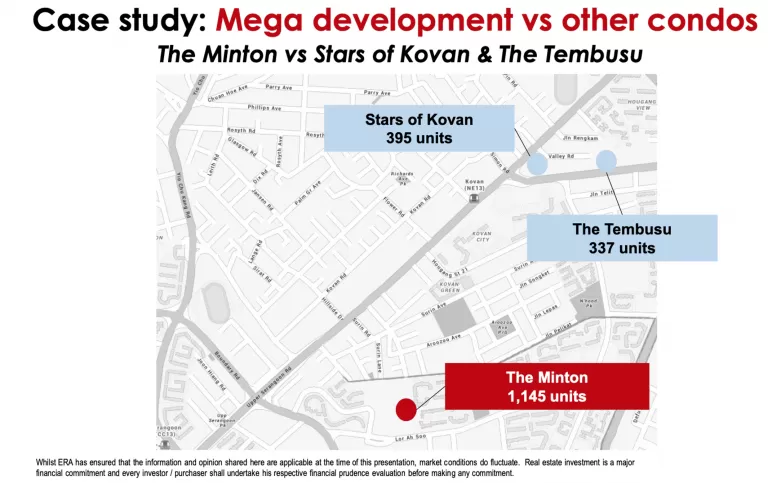

Now, let’s compare The Minton with other non-mega developments like Stars of Kovan (395 units) and The Tembusu (337 units). Keep in mind that The Minton is farther away from an MRT station as compared to Stars of Kovan and The Tembusu. This “disadvantage” surprisingly did not negatively impact the mega development, as you will see later.

*For more information on the MRT Effect on Property Prices, you may want to refer to this link.

Case Study 1

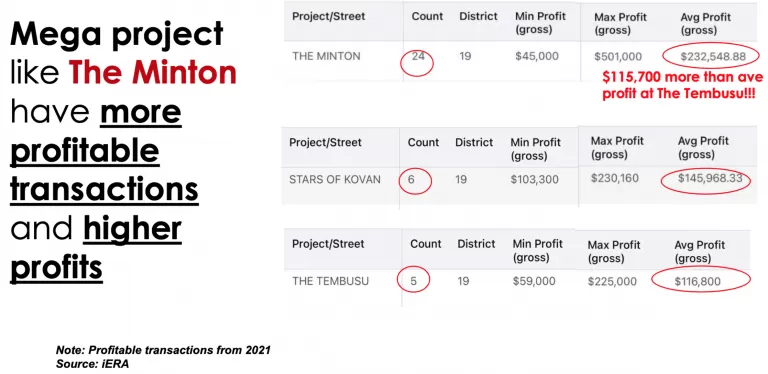

Take a look at the table below. For The Minton, in the month when 24 units were sold, the average profit was about $232, 548. On the other end of the spectrum, we have Stars of Kovan and The Tembusu (Leasehold vs Freehold) with average profits of $145, 968 and $116,800 respectively. Taken together, on average, mega projects like The Minton made $115,700 more than the average profit of smaller developments like Stars and Kovan and The Tembusu.

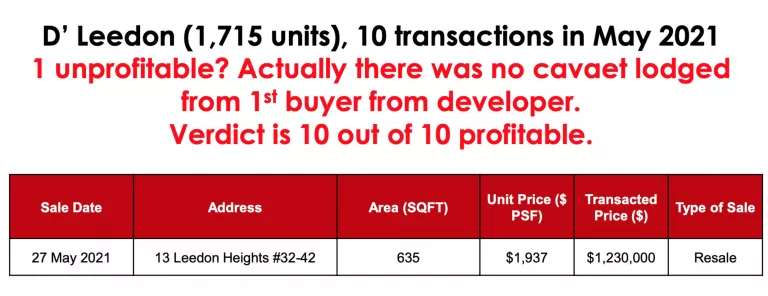

However, when we look at that 1 seemingly unprofitable unit, you will see that there was actually no caveat lodged from the first buyer from the developer. This means that the person who purchased the unit did not take a housing loan, and as such, does not appear in the data in terms of how much profit was made. Taking that into consideration then, 10 out of 10 units sold at D’Leedon are actually profitable.

Case Study 2

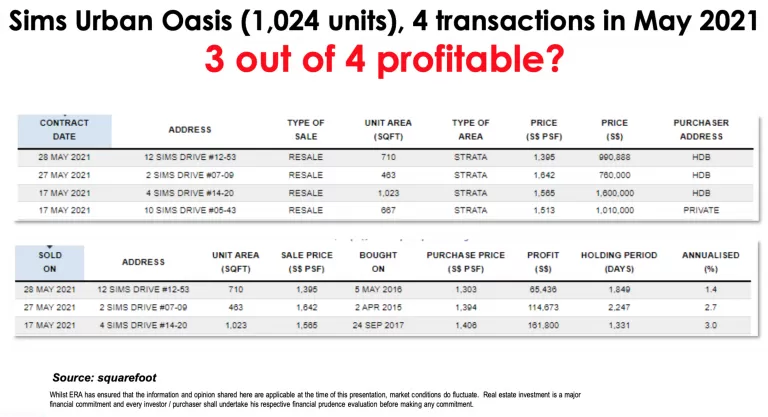

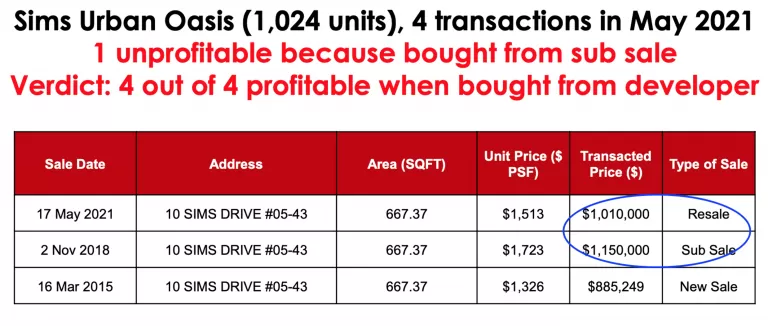

However, if we dig deeper, we’ll see that the 1 unit appears to be unprofitable because it was bought from sub sale. This means that the buyer bought the unit when the unit was still under construction. If you look at the data below, the buyer bought the unit from the developer at $885,249. 3 years later, the owner sold the unit when the unit was under construction. He sold it at $1.15 million. In 2021, the owner sold it at $1.01 million. It seems then that he made a loss of $50,000. However, we have to keep in mind that if the unit was bought from the developer at $885,249, a summable profit would have been made when the buyer sells the same unit.

In that sense then, the verdict would be that 4 out of 4 units of Sims Urban Oasis are profitable, when they are bought from the developer.

In fact, if you see this transaction, this investor made a profit of $264,751 and sold before the development is complete netting a Return of Investment of 30% in 3 years (10% return per year) and as he took a 80% loan at that time, his Return of Equity was actually 66.87% or 22% Return of Equity per Year!

4. Uniqueness

Another great reason for you to invest in a unit in a mega development is because of the uniqueness that it accords you. Oftentimes, residents are often spoilt for choice when it comes to facilities. Just take a look at Normanton Park below.

As you can see, at Normanton Park, each unit is actually elevated above ground. In that sense, there will be no talk of a “low floor unit” because every single unit belongs on a higher ground. In terms of facilities, the Normanton Park has a whopping 500,000 sqft of facilities, which includes four to five pools that you can get to dip into.

Apart from that, many mega developments are often surrounded by multiple other essentials that make them unique. For example, many mega developments are situated far away from MRT stations. To combat that, residents actually get to enjoy bus services that are more frequent and convenient. I have clients coming to me telling me that they love staying in mega developments because the bus comes so frequently that he has no issues getting to the MRT station. In fact, many of them thinks that it is way more convenient.

Mega developments are also unique because many of them actually include shops, restaurants, and even childcare facilities within the development so as to better serve the needs of its residents. This convenience is definitely attractive and beneficial.

Risks associated with mega developments?

We’ve been going on about the positives. Now, let’s talk about some of the common risks that people associate with mega developments. We’ll address them one by one.

Are there too many units and would it be hard to sell in future?

This is a question that I often hear. For this, I will introduce you to the 1 km Formula. In this formula, you should look at the 1 km radius of a development to calculate how many one-bedroom units there are in total. Using the 1 km Formula, you should apply it to two different developments that you wish to compare. Then, based on the amount that you calculated, you should look at mega developments that have a lower number of competitor units to make sure that it is a property that is worth investing in.

Alternatively, you can use another formula: Total transaction volume / Total number of units per year. This formula will tell you how well the mega development is selling. The number that you get will also help you single out projects that are well-received by consumers.

Is it hard to rent out?

Before you ponder on this question, it is best that you ask yourself about the profile of the tenant that you wish to rent out your apartment to, as well as what is the volume of your potential future tenant, in other words, where will your tenants be coming from? If you notice that your mega development in question is surrounded by many white-collar workers and expatriates, the chances of you renting it out to individuals from these profiles will be higher.

Is it hard to enbloc?

From historical data and examples, it seems that it is harder to enbloc mega developments. This is because developers have to buy an entire piece of land and pay its residents a sum of money when they want to enbloc. The total capital to enbloc a mega development—with more families and more units—will be higher. As a result, the chances of it being enbloc will be much lower.

Therefore, it would be wiser to avoid buying a mega development unit in hopes that it’ll enbloc. Instead, go for a new launch that will subsequently be easier to sell.

The Bottom-line

There you have it, a deep-dive study into mega developments in Singapore. Hopefully, this post will give you more confidence in purchasing a unit at a mega development. If you have your sights set on any mega development and are looking to purchase or enquire about them, who better to contact about luxury condos in Singapore than us here at SG Luxury Condo We’re here to help answer any questions that you might have and to help you land your dream home. Contact us now!