How Property Tax is Calculated in Singapore

In this article, we will be guiding you to calculate the property tax in Singapore.

After you have purchased your property in Singapore, the two main on-going fees to pay every year are the maintenance fees and the property tax. Maintenance fees are paid bi-yearly to the management office of the condominium and ranges from $300-500 depending on the size of the property. Property tax is paid to Inland Revenue Authority of Singapore (IRAS) once every year.

1. How is Property Tax Calculated?

Property Tax is the multiplication of the Annual Value of the Property and the property tax rate.

Property Tax = Annual Value of Property X Property Tax Rate

2. How is Annual Value Calculated?

The Annual value of a property is the estimated gross annual rent of the property if it were to be rented out, excluding furniture, furnishings and maintenance fees. It is determined based on estimated market rentals of similar or comparable properties and not on the actual rental income received.

There are 3 ways to determine the annul value of the property.

2.1 As the Legal owner

As the owner of the property, you can log in to IRAS website https://www.iras.gov.sg/digital-services/property-owners and go to the “View Property Dashboard”. Ensure that you have your Sing-pass with you to log in.

2.2 As a Buyer (Paid)

Alternatively, if you are a buyer and would like to find out the annual value of a property before purchasing, you can go in to https://www.iras.gov.sg/digital-services/property-professionals website, and go to the “Check Annual Value of Property”. You do not need a Singpass to log in. However, a fee of $2.50 is shareable for each enquiry.

2.3 As a Buyer (Free but Estimated)

Thirdly, you can go to any property portal and find out the estimated gross annual rent (monthly rent X 12 months). One place you can look at is in 99.co website, go to condo research and type in the condo which will show the past transaction for rental. Although this method is free, it is the most inaccurate as most people rent above the annual value.

3. Property Tax Rate

There are 2 types of property tax rates.

- Owner-occupied tax rates – where property is stayed in by the owner or is left empty

- Non-owner-occupied tax rates – where the entire property is lease out.

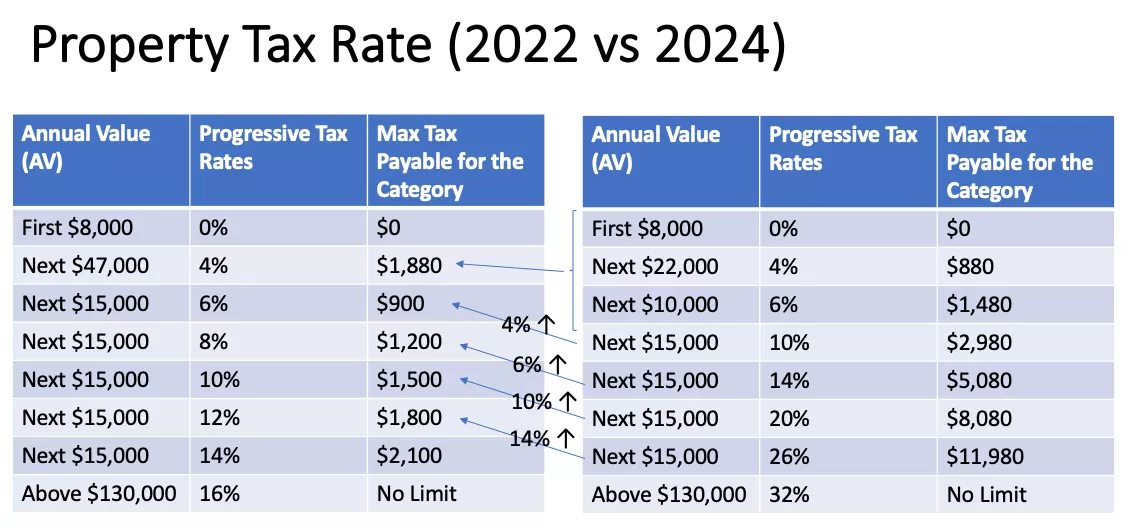

3.1 Property Tax Rate in Singapore for Owner-Occupied Properties

| Annual Value (AV) | Progressive Tax Rates | Max Tax Payable for the Category |

|---|---|---|

| First $8,000 | 0% | $0 |

| Next $47,000 | 4% | $1,880 |

| Next $15,000 | 6% | $900 |

| Next $15,000 | 8% | $1,200 |

| Next $15,000 | 10% | $1,500 |

| Next $15,000 | 12% | $1,800 |

| Next $15,000 | 14% | $2,100 |

| Above $130,000 | 16% | No Limit |

3.2. Property Tax Rate in Singapore for Non Owner-Occupied Properties

| Annual Value (AV) | Progressive Tax Rates | Max Tax Payable for the Category |

|---|---|---|

| First $30,000 | 10% | $3,000 |

| Next $15,000 | 12% | $4,800 |

| Next $15,000 | 14% | $6,900 |

| Next $15,000 | 16% | $9,300 |

| Next $15,000 | 18% | $12,000 |

| Above $90,000 | 20% | No Limit |

4. Example how Singapore Property Tax is Calculated

There are 2 types of property tax rates.

- Owner-occupied tax rates – where property is stayed in by the owner or is left empty

- Non-owner-occupied tax rates – where the entire property is lease out.

5. New Property Tax Rate in Singapore for Owner-Occupied Properties (from 2024 onwards)

| Annual Value (AV) | Progressive Tax Rates | Max Tac Payable for the Category |

|---|---|---|

| First $8,000 | 0% | $0 |

| Next $22,000 | 4% | $880 |

| Next $10,000 | 6% | $1,480 |

| Next $15,000 | 10% | $2,980 |

| Next $15,000 | 14% | $5,080 |

| Next $15,000 | 20% | $8,080 |

| Next $15,000 | 26% | $11,980 |

| Above $130,000 | 32% | No Limit |

6. Difference between the tax rates for Owner-occupied properties before and after 2024

Implications for the future New Tax Rates

Looking at the changes to the new tax rates that was announce in Budget 2022 and happening in 2024, here are my predictions. From my video, I expect people to stay in the lower tax bracket, hence, using the formula of

Gross Rental Yield (3%) = Annual Gross Rent / Purchase Price X 100%

I expect for owner occupied, there will be a higher demand for (due to staying in the lower tax bracket):

- < $1.3m – 2 Bedroom

- < $1.8m – 3 Bedroom

As for investment, there will be a higher demand for:

- < $1m – 1 Bedroom

- <$1.5m – 2-3 Bedroom

Moreover, I do expect 2 other trends:

- Overall rental in Singapore to increase to cover the additional property tax

- Demand for new properties (with lower annual value) to increase