The MRT Effect: How MRT Stations Affect Property Prices

Most of us find it difficult to recall a time before the existence of Singapore’s Mass Rapid Transit (MRT) system. When it first began operating on 7 November 1987, the first five MRT stations were on the North South Line and was merely 6km long. The first five stations that opened included Yio Chu Kang, Ang Mo Kio, Bishan, Braddell, as well as Toa Payoh.

Today—more than 30 years since Singapore MRT’s inauguration—we see about 130 stations across six MRT lines span the island and an average of approximately 3.3 million passengers a day use the MRT in Singapore.

Without a doubt, the MRT system has helped to maximise land use possibility for a small island state like Singapore. It has also greatly improved our transport connectivity—albeit the occasional MRT breakdowns—making it convenient for us to travel from one end of Singapore to the other. Just ask any of our foreigner friends and you will hear about how they love the convenience of the MRT in Singapore as compared to their home country.

However, the difference that the MRT has made onto our lives does not just stop there. The MRT, ever since it was first introduced, has far-reaching influences. For one, it has greatly increased the attractiveness of residential developments near MRT stations. This in turn has an impact on property and rental prices.

News about new and existing MRT stations and MRT lines therefore garner a large following, especially by those who are in the Real Estate scene.

In this article, we will dive deep into what we call the MRT Effect. Specifically, we answer the age-old question of “How does the announcement, proximity, construction, and commencement of a new MRT station or line nearby affect an existing development’s value?”

Age of Development

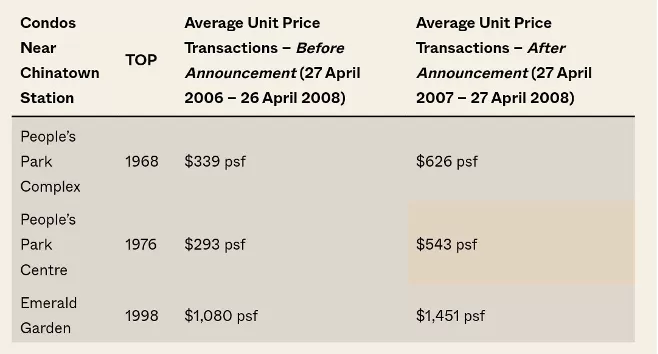

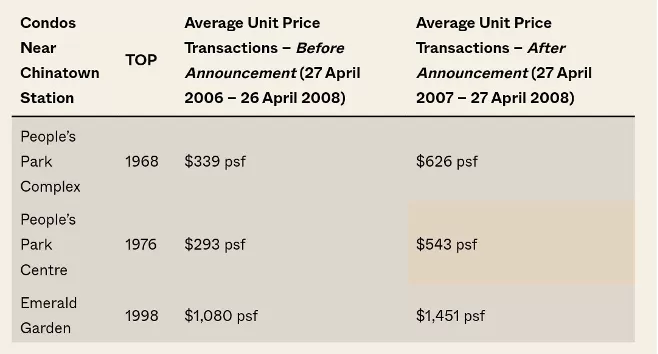

The effect of the announcement of a new MRT line on housing prices is also influenced by the age of a development in the area. In older areas such as Chinatown, the announcement of a new MRT line greatly increased the prices of nearby developments, as seen below.

This could be because older units tend to have a lower per square feet unit price to start with. The announcement of a new MRT line could thus drive up the interest in houses in the area, causing an increase in unit prices. Couple this with the fact that older developments typically see larger units, and you will realize that the per square feet increase actually adds up to quite a significant amount. Thus, in older estates, developments see even larger gains after the announcement of an MRT line.

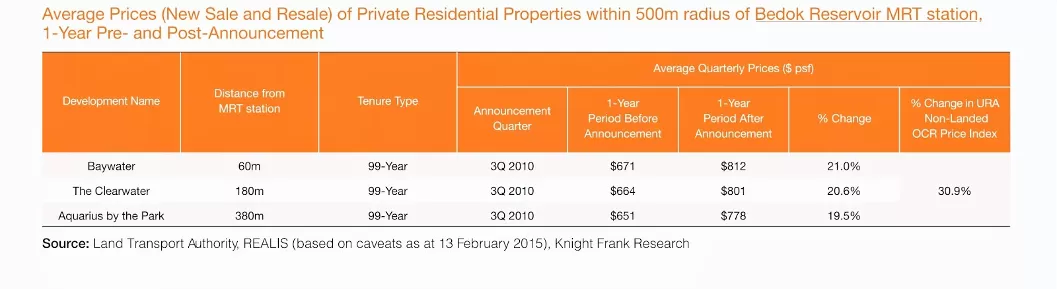

The effect of the announcement of a new MRT station or line also extends to new developments. According to Knight Frank Research, following the announcement of a new MRT station or line, home developers tend to roll out new units at higher selling prices that set new price benchmarks. If you look at new development launches within the vicinity of Bedok Reservoir MRT station, you will see that in the one-year post announcement period, new sale average prices rose by 32.7% to $1004 per square foot. Similarly, the per square foot price of Waterfront Key rose by 32.3% to $1013 in the same period.

This means that home developers may, and do in fact, capitalize on many homebuyer’s desire for greater convenience and accessibility such that they take into consideration the MRT effect when setting prices of developments post announcement.

Taken together, then, the effect of the initial announcement of the development of an MRT station or line is significant. It is influenced by factors such as the age of the housing area, as well as the prior accessibility of the area. Additionally, just as the announcement may impact existing developments prices, it can also set the benchmark of prices for new development launches.

Proximity’s Effect on Housing Prices

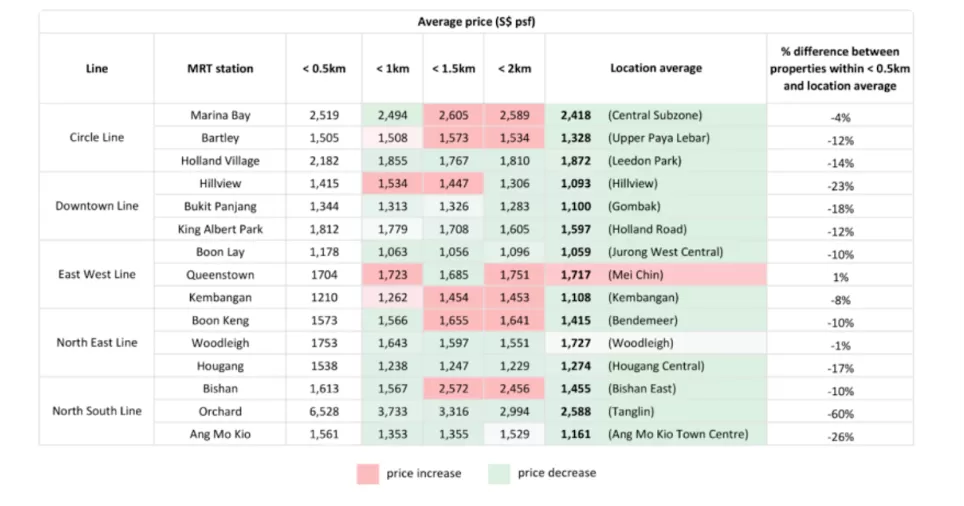

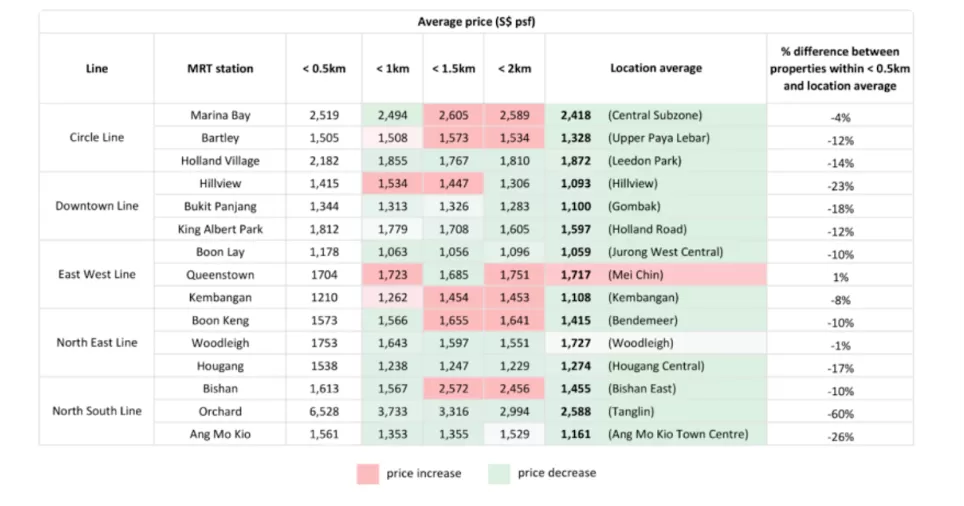

Now that the first case study has shed some light on the effect of the initial announcement of the development of an MRT station or line on property prices, let us explore proximity’s effect on property prices. To do that, we will take a look at a case study that compares advertised prices for private apartments and condominiums within 0.5km, 1km, 1.5km and 2km of 15 MRT stations against average asking prices of the same types of properties in surrounding or neighbouring locations.

As seen from the table above, properties closer to MRT stations have almost always been considerably more costly than property prices in the vicinity or neighbourhood. Overall, properties within 0.5 km of an MRT station demanded a 15 percent premium over those in the neighbouring or adjacent area in general.

When comparing the average asking price for properties within 0.5 km of an MRT station to that of a property within 1 km of an MRT station, you would observe that it is generally more expensive to purchase properties from the former group. Although, it is worth noting that this difference is very marginal for most areas.

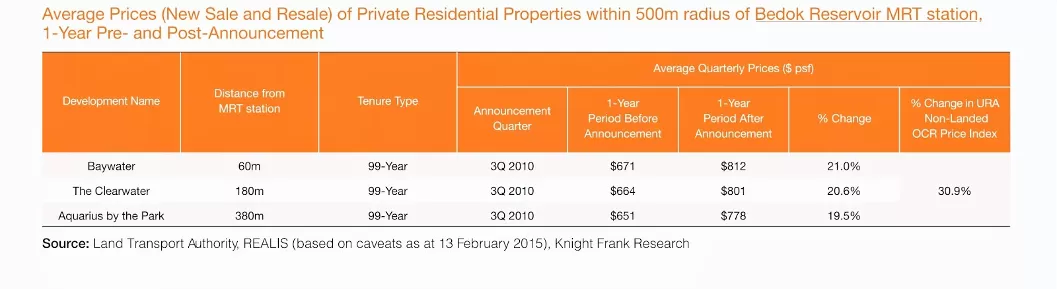

The effect of proximity on housing prices is also evidenced in the analysis of price changes of specific developments within the vicinity of Bedok Reservoir MRT station.

As seen in the table above, Baywater, a development that is less than 100m away from the station, saw a 21% increase within two years of the announcement of the development of an MRT station. On the other hand, Aquarius by the Park, a development about 400m away from the station, saw a lower increment.

Simply put, in terms of proximity’s effect on housing prices, it is clear that generally, the nearer the development is to an MRT station, the higher the average price. This result is not surprising, considering the fact that being close to an MRT station brings about a lot more convenience and accessibility.

Commencement of Construction’s Effect on Housing Prices

While the announcement and proximity of an MRT station generally have a positive impact on housing prices of surrounding residential developments, these positive gains and prices constantly fluctuate along with the development life cycle of the MRT station—prices typically trend lower in the construction phase.

A study conducted by Knight Frank Research found that shortly after the announcement of MRT development plans, owners of residential developments situated in close proximity to the station would benefit from the initial attraction that homebuyers would show. This initial interest would then translate to the potential price gains that we see from the examples above. Post announcement, homeowners would likely benefit from the higher price gains as well.

However, once construction and MRT infrastructure works commence, noise pollution, air pollution, as well as traffic disturbances that arise due to the construction phase may affect the surrounding environmental conditions and in turn impact property values. This impact of externalities on property value can be seen in the table below, where developments situated near Bedok Reservoir MRT station saw a decline of 9.8% when construction commenced.

This could be because older units tend to have a lower per square feet unit price to start with. The announcement of a new MRT line could thus drive up the interest in houses in the area, causing an increase in unit prices. Couple this with the fact that older developments typically see larger units, and you will realize that the per square feet increase actually adds up to quite a significant amount. Thus, in older estates, developments see even larger gains after the announcement of an MRT line.

The effect of the announcement of a new MRT station or line also extends to new developments. According to Knight Frank Research, following the announcement of a new MRT station or line, home developers tend to roll out new units at higher selling prices that set new price benchmarks. If you look at new development launches within the vicinity of Bedok Reservoir MRT station, you will see that in the one-year post announcement period, new sale average prices rose by 32.7% to $1004 per square foot. Similarly, the per square foot price of Waterfront Key rose by 32.3% to $1013 in the same period.

This means that home developers may, and do in fact, capitalize on many homebuyer’s desire for greater convenience and accessibility such that they take into consideration the MRT effect when setting prices of developments post announcement.

Taken together, then, the effect of the initial announcement of the development of an MRT station or line is significant. It is influenced by factors such as the age of the housing area, as well as the prior accessibility of the area. Additionally, just as the announcement may impact existing developments prices, it can also set the benchmark of prices for new development launches.

Proximity’s Effect on Housing Prices

Now that the first case study has shed some light on the effect of the initial announcement of the development of an MRT station or line on property prices, let us explore proximity’s effect on property prices. To do that, we will take a look at a case study that compares advertised prices for private apartments and condominiums within 0.5km, 1km, 1.5km and 2km of 15 MRT stations against average asking prices of the same types of properties in surrounding or neighbouring locations.

As seen from the table above, properties closer to MRT stations have almost always been considerably more costly than property prices in the vicinity or neighbourhood. Overall, properties within 0.5 km of an MRT station demanded a 15 percent premium over those in the neighbouring or adjacent area in general.

When comparing the average asking price for properties within 0.5 km of an MRT station to that of a property within 1 km of an MRT station, you would observe that it is generally more expensive to purchase properties from the former group. Although, it is worth noting that this difference is very marginal for most areas.

The effect of proximity on housing prices is also evidenced in the analysis of price changes of specific developments within the vicinity of Bedok Reservoir MRT station.

As seen in the table above, Baywater, a development that is less than 100m away from the station, saw a 21% increase within two years of the announcement of the development of an MRT station. On the other hand, Aquarius by the Park, a development about 400m away from the station, saw a lower increment.

Simply put, in terms of proximity’s effect on housing prices, it is clear that generally, the nearer the development is to an MRT station, the higher the average price. This result is not surprising, considering the fact that being close to an MRT station brings about a lot more convenience and accessibility.

Commencement of Construction’s Effect on Housing Prices

While the announcement and proximity of an MRT station generally have a positive impact on housing prices of surrounding residential developments, these positive gains and prices constantly fluctuate along with the development life cycle of the MRT station—prices typically trend lower in the construction phase.

A study conducted by Knight Frank Research found that shortly after the announcement of MRT development plans, owners of residential developments situated in close proximity to the station would benefit from the initial attraction that homebuyers would show. This initial interest would then translate to the potential price gains that we see from the examples above. Post announcement, homeowners would likely benefit from the higher price gains as well.

However, once construction and MRT infrastructure works commence, noise pollution, air pollution, as well as traffic disturbances that arise due to the construction phase may affect the surrounding environmental conditions and in turn impact property values. This impact of externalities on property value can be seen in the table below, where developments situated near Bedok Reservoir MRT station saw a decline of 9.8% when construction commenced.

What this essentially means is that the gains in housing prices following the initial announcement and the period after the announcement may be short-lived due to the adverse effects of construction of infrastructure. Perhaps this means that people want the added layer of convenience and accessibility that an MRT station brings and are willing to pay higher prices to purchase this luxury. However, they are less willing to do so when it means that they have to compromise in terms of having to withstand the negative externalities of infrastructure construction.

Analysts also suggest that properties hit badly by construction work would see a temporary dip in prices. It is forecasted that once an MRT line is ready, nearby properties could enjoy a premium of 10% to 30%, depending on proximity and market conditions. This could mean that the temporary dip could provide a great window of opportunity for homebuyers to jump in.

The reversal of this effect is seen in the next phase of development, which sees the actual commencement of operation.

If we look at the price changes for private residential developments on the Circle Line post operation commencement, you will see that the average percentage pricawe increase for Lorong Chuan MRT station is higher than that of Holland Village MRT station. This is because in suburban areas like Lorong Chuan, residents are likely to rely greatly on the MRT to get to the central areas of Singapore, or other parts of the island. Therefore, the commencement of operation of a new MRT line or station is likely to cause a significant increase in housing prices in these areas, as compared to an area that does not rely too much on public transport, like residents of Holland Village MRT station.

In addition, if a station is located far from the city centre, requiring residents to change lines or wait through many stations to get to their destinations, then it may not greatly push home prices up.

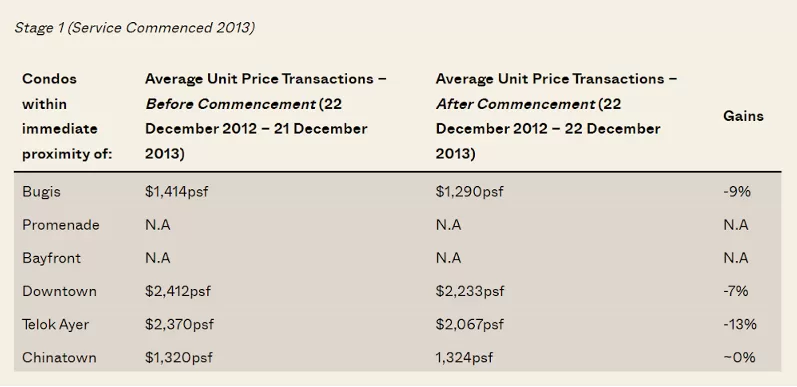

The same conclusion that the effect of post-commencement differs depending on the precise location of a station is drawn when we look at the case of the Downtown Line MRT Stations. The commencement of operation of the Downtown line was divided into two stages.

In the first stage in which services commenced in 2013, you can see that unlike the obvious gains in unit prices in the previous cases, the gains in this case spot a downward trend.

Similarly, in the second stage of the commencement of the services of the Downtown Line, you can observe that developments within the immediate proximity of the new MRT stations fared badly in terms of gains.

The poor gains of the developments along the Downtown Line can be attributed to the fact that many of these developments already had exclusivity factored into their prices. These upscale districts were already in central areas of Singapore and are well-connected. Therefore, they do not experience the same upsides when a new MRT station or line commences operation.

When we look at the cases of the Circle Line and the Downtown Line in totality, we can come to the conclusion that in terms of the effects of commencement of operation on housing prices, convenience is key. When a new MRT station commences its operation, residents can likely assess if it greatly provides them with better connectivity and accessibility. In areas of the Circle Line and Downtown Line where

(i) accessibility was already high before the development and commencement of a new MRT station,

(ii) residents do not rely on public transport, and

(iii) exclusivity was factored into the development’s prices, the commencement of operation would unlikely translate to higher capital gains in pricing.

The MRT Effect

Clearly, from the case studies above, the MRT effect is rather great. It is, however, not all-encompassing—buying a property near an MRT station does not naturally lead to greater home appreciation. Many other factors affect the relationship between the MRT effect and housing prices.

Here is a summary of the key points that you should take away from this article.

- Prices of nearby developments increase following an announcement of a new MRT station or line. However, the effect of announcement on housing prices is dependent on many factors such as age of development as well as previous characteristics of the housing area.

- The announcement of a new MRT station or line can also increase or set the price benchmark of new developments and launches.

- The nearer the development is to an MRT station, the higher the average price. This result is not surprising, considering the fact that being close to an MRT station brings about a lot more convenience and accessibility.

- Once construction and MRT infrastructure works commence, noise pollution, air pollution, as well as traffic disturbances that arise due to the construction phase may affect the surrounding environmental conditions and in turn impact property values, causing nearby property prices to decline.

- Commencement of operation of an MRT station or line may accord residents with an added layer of convenience and would likely attribute to gains in unit prices of developments nearby.

- The effect of post-commencement differs depending on the precise location of a station; upscale districts that were already in central areas of Singapore and are well-connected will not experience the same upsides when a new MRT station or line commences operation.

It is also important to note that the MRT effect is just a small part of what affects the value of property. Many other issues come into play when we consider the factors that affect home prices.

Future Prospects

With all these learning points in mind, what does it all mean for you? To put things into perspective, the Thomson-East Coast Line whose stations were announced in 2014 will be fully completed in 2024. This will form Singapore’s sixth MRT line. The new line would enhance overall accessibility and reduce the travelling time to the Central Business District area in Singapore, for those living in suburban regions.

Furthermore, the Government has accepted the recommendations of the 2040 Land Transport Master Plan advisory panel, which includes building three more MRT lines so that eight in 10 Singaporeans will be within a 10-minute walk of an MRT station by 2030.

The table below shows the average prices of 12 private condominiums within 0.5km of Thomson-East Coast MRT stations over the past few years. Aside from Faber Green Condominium, Four Seasons Park and Camelot, the other properties did not see any meaningful gain in the past few years. However, as we have learned earlier, this could be due to the construction work going on in the surrounding areas—construction of new stations means having to bear with air and noise pollution, disruptions in traffic and road diversions. This temporary dip will likely end once the line is completed, and property prices of nearby developments would likely increase.

Similarly, for other new MRT lines of the future, there will undoubtedly be a huge effect on the Singaporean property market for the forthcoming MRT stations. For units located near MRT stations, the value of property is expected to grow.

However, as more and more Singaporeans begin to live near MRT stations, it could also mean that properties near a station may no longer command big price premiums, and that newer stations may not push prices up as much as they have in the past.

Additionally, there are many unknowns right now in the property market—the global pandemic being one. Nonetheless, the MRT Effect is a trend that is worth keeping your eye on. Spend some quality time learning and researching on potential opportunities.

With so many uncertainties, we can take comfort in the one thing that we know for sure—whether you are a residential homebuyer or a real estate investor within Singapore, you can and you should never ignore the impact of MRTs on your property investments.