Everything you need to know about undervalued and profitable properties

As a realtor, I have many clients ask me,”Do you have any undervalued properties?” That’s the million dollar question isn’t it? We all want to buy properties where the price are 10 years ago.

In any kind of real estate market, there are simple rules of logic that can help you to distinguish between properties so that you can gear your efforts towards profits in value and growth markets. These simple rules can be applied for you to detect strong investment opportunities in today’s real estate markets.

Often times, when you research and study topics that are related to the realm of real estate, you will come across terms and jargons such as “undervalued properties” as well as “profitable properties”. To be successful in your investment efforts, it is paramount that you understand these widely used terms. Many sites, however, do not go on to explain each term. They seem to expect every home buyer to understand these terms. If you are confused about the meanings and definitions of such terms, read on to learn everything you need to know about undervalued and profitable properties!

Undervalued Properties

Put simply, an undervalued property is one that is being sold in the market for less than its worth. For a homebuyer or homeowner, undervalued homes simply mean that the purchase price of the property you are buying or selling is less than the home’s actual value, market value, or the amount that is indicated by its bank valuation.

Because undervalued properties are typically older, they are great options for those who are looking for higher rental yield.

Identifying Undervalued Properties

There are four main features that you can look out for in order to identify undervalued properties.

1. Difficulty in selling

Properties that are difficult to sell will likely be undervalued in order to entice buyers to purchase them.

2. Low transaction volume

Transaction volumes can help us to understand the current sentiment of any real estate market. To identify undervalued properties, look out for those with low transaction volumes.

3. Desperate seller

One great way for you to identify undervalued properties is to look out for motivated sellers. Because it is difficult to sell and has low transaction volume, owners of such properties would usually want to let go of these properties as quickly as they can.

Perhaps the owners have already purchased a property elsewhere, or they are in financial trouble! The homeowner may be in distress and needs to sell quickly, accepting a discount for a quick closing.

Either way, these sellers will more likely accept lower offers and sell their properties below the bank valuation. Therefore, it is good for you to try to discern how desperate sellers are in trying to get the property off their hands.

4. Age of property

Undervalued properties are usually 10 to 15 years old. They are typically more than 10 years old

Profitable Properties

A profitable property is a property that can give you a return of investment when you choose to sell it away. Many successful property investments begin with identifying profitable properties.

Because of its great return of investment, profitable properties are great for those who intend to build on their wealth. These investors would buy an investment property, hold it for a few years, and sell it at a gain to earn more money!

Identifying Profitable Properties

1. High in demand

Profitable properties are typically high in demand. And due to this strong demand, people are more willing to pay above the bank valuation to purchase the property. In turn, the valuation of these properties will go up.

2. Great location

Many profitable properties, transactions, as well as investments are often located at great, central, or growth locations. Profitable properties are likely to be found in the Central Region of Singapore.

3. Age of property

Profitable properties are typically young, and are less than 5 years old.

Undervalued VS Profitable Properties

It is easy to get confused over the differences between undervalued and profitable properties. Many people have the misconception that undervalued properties are equivalent to profitable properties because they believe that buying something cheap is the best way to make money in the real estate market. However, this is not always the case. When a property is undervalued, it does not necessarily mean that it is profitable.

Just as how you would likely be sceptical enough to question food sellers why they are selling their products off at extremely cheap prices, dig deep to find the real reason why a property is being sold lower than its market value. Do not buy a property simply because it is cheap or undervalued.

While an undervalued property does not equate to it being profitable, a profitable property can be undervalued.

Case Study 1 – Queenstown

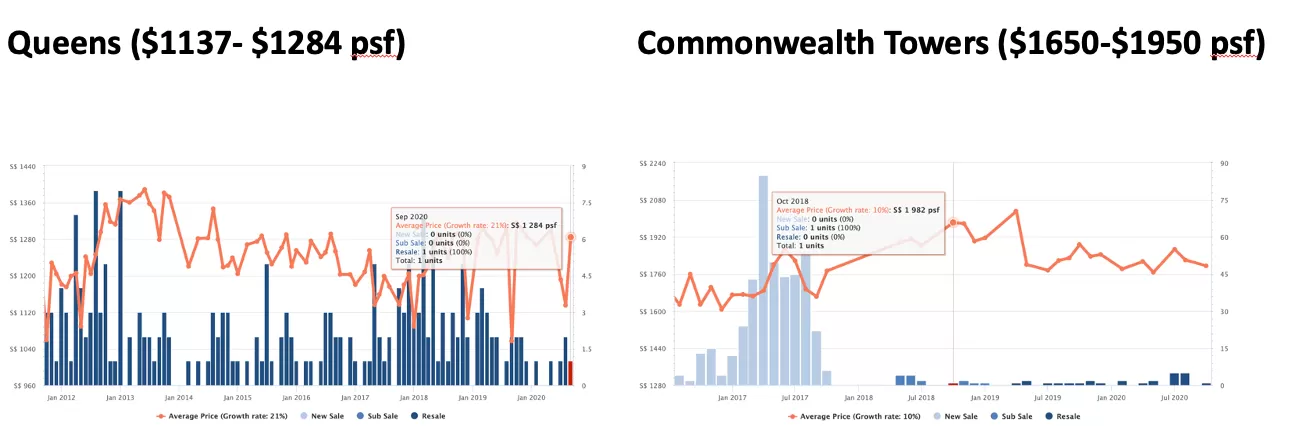

Let’s rewind back to 2015 and see some examples. In 2015, there is 2 properties for sale; one is a resale property called the Queens that is completed in 2002, the other is a building under construction (BUC) condo called commonwealth tower.

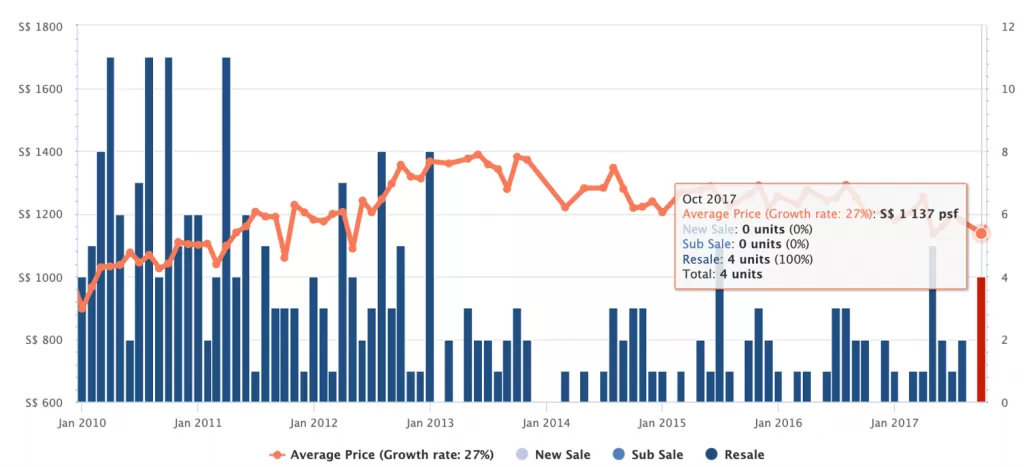

From the graph above you can see that in 2015, the price of the Queens is undervalued, that is price below valuation. Even in 2017, the price is also under-valued where it reaches an all time high of $1400 psf in 2014. The Queens in 2015-2017 is sold at a $1,137 psf.

Meanwhile, Commonwealth Towers by Heong Leong, a BUC project is been selling at $1,600-1,700 psf. Even in 2017, when another new condo was launched, the Queens Peak is selling at $1,650 psf. Given a choice at that time, which project will you buy?

If we were to wind forward to year 2020, the Queens would have gain up to $1284 psf giving a return of investment of 2.29% per annum while looking at Commonwealth Towers, it would have grow to $1,950 psf giving an annum return of investment of 5.13%! That’s more than double the growth of Queens even though it is under-valued.

Reasons why Commonwealth Towers is able to give a much better return of investment is because

- it is a new project, people are more willing to pay more for a newer project.

- There is no new projects in Queenstown area, hence giving it a first mover advantage

- Although Commonwealth Tower has a high PSF, it has a smaller size and overall it is more affordable for homebuyers.

- Developer Pricing Strategy – developer raises price periodically, which cause the valuation to increase. When valuation increase, naturally the first movers will be able to profit more.

Case Study 2 – Bartley

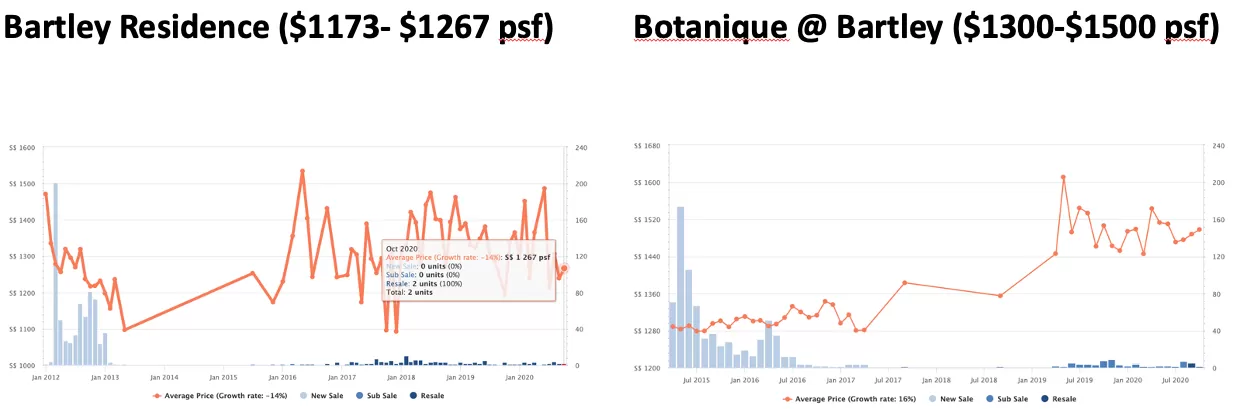

Here is another example of 2 projects; Bartley Residence vs Botanique at Bartley.

Bartley Residences is a relatively new project that TOP in 2015. In the graph below, you can see that at it’s peak, Bartley Residence is sold at $1,480 psf and now it is 30% below valuation! Would you buy at $1,173 psf?

Meanwhile, across the road, Botanique @ Bartley developed by UOL is selling at $1,300-1,400 psf. Of the 2 projects, which will you choose?

Looking at the data above, Bartley Residence over a period of 5 years from 2015-2020, it grew from $1,173 to 1,267 psf giving a 1.48% per annum. However, if you look at Botanique @ Bartley, it grew from $1,300 to $1,500 psf, giving it a return of investment of 3.07% per annum! Both case studies actually gave double the investment return.

I would like to point out that overall, most BUCs or new developments usually will have a 10-20% return if they follow a certain set of rules (more below).

How to find Undervalued Properties

Useful Tools

There are several tools and resources that you can make use of in order for you to identify if properties are undervalued.

EdgeProp Singapore for Undervalued Properties

While you can simply head to a bank to ask for a property’s valuation in order to identify an undervalued property, some may find it troublesome. If this sounds like you, EdgeProp Singapore could be a great tool for you.

On EdgeProp, a property portal designed for home-seekers, buyers, investors, and real estate agents, search up keywords and characteristics such as “undervalued properties”. The portal will churn out detailed percentages to tell you exactly how low each property is below the bank valuation. This is much more efficient than going to the bank!

How to find Profitable Properties

Property P.L.U.S System and 4 “P” Model for Profitable Properties

The process of identifying and finding profitable properties is slightly more challenging as compared to identifying undervalued properties.

Through years of experience and research, the Property P.L.U.S System and the 4 “P” Model was developed to help clients find profitable properties. With these models, you would be able to identify properties that are more profitable in nature, as well as those that have a higher chance for you to build wealth.

Click on this link to chat with us to find out more!

Conclusion

There you have it, a comprehensive and detailed guide on everything you need to know about undervalued and profitable properties! Be sure to read the whole thing again in order to develop a thorough understanding of the terms so that you do not make rookie mistakes when deciding on your next investment property!